SPECIAL REPORTS

Data: 21 December 2019 Author: Maciej Zaniewicz

New Gas Pipeline Geopolitics in Central and Eastern Europe

The current gas pipeline system in Central and Eastern Europe started to be built in the 1960s. Apart from commercial purposes, it was intended to make the countries of the Eastern Bloc reliant on energy supplies from the Soviet Union. Just like it was asserted in the Falin-Kvitsinsky doctrine, a Moscow-devised strategy that endeavored to substitute military influence with economic pressure.

- In its relations with Central and Eastern European countries, Russia is pushing forward its policies of what was referred to as “obedience bonus” and “management by crisis.” The price of natural gas set for the countries that remain reliant on Russian-sourced energy depends on what political course they have embarked towards Moscow. What serves as a tool for exerting pressure are gas crises that consist in shutting down energy supplies;

- Moscow’s gas fights with Ukraine yet tarnished Russia’s reputation as an energy supplier. In a bid to remove this dependence, seen as highly disadvantageous for Moscow, Gazprom rushed to implement a couple of its top energy projects: the Nord Stream, Nord Stream 2 and TurkStream pipelines, all of which were intended first and foremost to shut down Russian gas transit through Ukraine.

- In the best-case scenario for the Kremlin, these projects, once fully implemented, would allow halting gas supplies to Ukraine while leading to acute crises in Central and Eastern Europe, albeit with no harm to Moscow’s Western European partners.

- It is in the best interest of both Poland and the countries of the region to mitigate any crippling effects of Gazprom’s newest energy projects. They all have adequate tools for implementing such a policy. These include, among other items, the recourse to European institutions to reduce volumes of gas shipments via Nord Stream and Nord Stream 2, embracing liquefied natural gas technology to diversify energy supplies and the extension of energy connections between the countries of Central and Eastern Europe.

Źródło: Iren Moroz/Fotolia

Źródło: Iren Moroz/FotoliaBackground

Fifty years ago, on June 1, 1968, the Soviet company Soyuznefteexport and Österreichische Mineralölverwaltung (OMV) signed an agreement for supplying natural gas from the USSR to Austria in a move that could be branded as symbolic for the construction of the present-day gas infrastructure across the region. Never before had Soviet-sourced energy supplies reached Western Europe. In a mere three months, gas supplies arrived in the Baumgarten station in Austria. Referred today as Europe’s largest gas hub, the Central European Gas Hub, or CEGH, is the fulcrum for Russian energy shipments to Europe.

The 1980s saw an intense development of the gas supply system across Central and Eastern Europe. In 1984, the “Brotherhood” pipeline (Urengoy-Pomary-Uzhgorod) was commissioned as the top energy trunkline running through Russia, Ukraine and Slovakia to the Baumgarten gas hub in Austria. From the very beginning, the pipeline’s route was subject to political matters as the Soviet Union trusted neither Poland nor East Germany, seeking to prevent these two from gaining control over the gas tap. That is why a decision was made to build a longer branch of the pipeline through Gustáv Husák’s Czechoslovakia that remained at the time under the strict control of the Soviet Union.

The gas transmission line, alongside an oil pipeline network, laid the groundwork for a new Russian strategy to exert control over the countries of the former Eastern Bloc. This was chiefly of economic significance as these two paved Moscow’s way for the inflow of foreign currency and a significant increase in budget revenues. Russian income from sales of crude oil and natural gas bring in the biggest part of the country’s export profits. Revenues from trading raw materials are still of utmost importance, with the Russian state budget based on the projected price of crude oil.

Nonetheless, Soviet politicians grew aware of the dangers of the state’s excessive dependence on revenues from raw materials. Therefore, in the absence of opportunities to reduce such reliance, they decided to employ the gas infrastructure, back then under construction, for political purposes.

Yet ahead of the fall of the Soviet Union, two Soviet diplomats – Valentin Falin and Yuli Kvitsinsky – prepared a special strategy that assumed the use of strategic transmission infrastructure to exert economic pressure on the countries of the Eastern Bloc without the use of military force. Dubbed the Kvitsinsky-Falin Doctrine, the Soviet-made plan has served as the core of Russian policy towards Central and Eastern Europe roughly 30 years after the collapse of the Soviet Union.

Shortly after it was developed, the doctrine applied specifically to oil pipelines. With new transmission lines being constructed came the region’s increased dependence on Russian-sourced energy and, in consequence, Moscow’s stronger possibilities to expand the scope of the doctrine. But what was later done by subsequent governments, including the Polish one, showed that they were either unaware of the threat or made purposeful efforts to deepen their reliance on Russia. Even after the demise of the Soviet Union.

Seen as vital for pumping gas to the region, the second gas pipeline was built over the decade after the commissioning of the “Brotherhood” trunkline. The transnational Yamal – Europe gas pipeline, which became operational in 1997, ran from Russia to Germany, through Belarus and Poland. The decision to press ahead with the project emerged in the 1990s, amidst Poland’s steeply rising demand for natural gas. And yet the investment had excited a lively controversy far before the gas pipeline became operational at all. First of all, once commissioned, the pipeline gave rise to Poland’s long-lasting dependence on a single supplier. Secondly, Poland managed its leg of the Yamal pipeline in a manner that virtually left the country with no major revenues from being a transit country for the trunkline. EuRoPol Gaz, which owns the Polish stretch of the Yamal pipeline, made roughly 20 million zlotys a year. Furthermore, the company’s articles of association required that both Poland’s oil and gas company PGNiG and Russia’s Gazprom –– as two strategic shareholders –– give their consent to the management board to make necessary decisions. In consequence, PGNiG, which holds both directly and indirectly 52 percent of the voting rights, still needs consent from Gazprom, though the latter has a 48 percent stake.

Management by crisis

Therefore, such-designed natural gas pipeline network had some far-reaching consequences. First and foremost, it made countries across Central and Eastern Europe as the Balkans profoundly reliant on Russian-sourced energy.

The region’s profound dependence on Russian gas supplies allowed the Kvitsinsky-Falin doctrine to be put into practice. It relied on two mechanisms. First, gas prices were tied to what foreign policy was pursued by a country that bought natural gas supplies from Russia in a move to grant an “obedience bonus” to those most favorable to Moscow. The second option was what was referred to as the “nuclear solution,” which was the cutting off of all gas supplies in the heating season.

Moscow has a long tradition of applying its “obedience bonus,” or the first tool for bringing to bear economic pressure, in relation to the countries that import Russian natural gas volumes. The more profound is the country’s dependence on Russia, the more effective is the policy. While examining the prices of gas for countries across the region and how these changed, both over time and with subsequent governments in power, one could distinguish a clear-cut relation between how much support the latter lent to Russia and the cost of buying Russian energy.

Countries like Austria, Hungary or Germany, all of which are supportive towards Moscow’s energy policy, buy gas cheaper ($397.4, $390.8 and $379.3 respectively) than Denmark ($495), Lithuania , Poland ($525.5) or Ukraine ($426). Interestingly, no correlation is observed between price and the degree of reliance on gas supplies. Moscow traded its natural gas volumes to Finland, a country entirely dependent on Russian energy, at the rate of $384.8 .

A graphic example of Russia’s using the price mechanism as a tool for influencing states across the region was what Moscow offered to Ukraine back in 2013. During a meeting of Viktor Yanukovych, who at that time served as Ukrainian president, in Petersburg, Ukrainian officials agreed to pull out of the EU Association Agreement (AA) in exchange for a cut in the price of natural gas to $268.5 per 1,000 cubic meters, from about $400, and $750 million in loans. Earlier Ostchem Group DF –– a chemical firm owned by a Ukrainian tycoon Dmitro Firtash, who lobbied for Russian interests in Ukraine –– had signed a deal to trade gas at $260 per thousand cubic meters. The Ukrainian delegation’s green light to the Russian offer sparked outcry in the country, or what was widely known as the Revolution of Dignity, the movement en masse that toppled Ukraine’s pro-Russian president and the government.

Secondly, Russia fell back on what was named as management by crisis and triggered a few gas crises back then. But this tool did not refer inasmuch to the long-term attitude to Russian policy, instead pertaining to specific steps taken by countries of Central and Eastern Europe.

Russia first used its energy resources as a tool for economic pressure in 2006 in response to Ukraine’s pro-Western endeavors during the 2004 Orange Revolution. Before, Kiev has bought Russian gas for only $80 per 1,000 cubic meters. This price also held for the transit of Turkmen gas through Russia to Ukraine.

Since 2004, Russia has closely monitored Ukraine’s pursuits towards better ties with the European Union and NATO. A year later, in 2005, Moscow started to pressure on Ukraine over gas. As lengthy negotiations went on, Russia said it saw its gas price for Ukraine at around $230 per 1,000 cubic meters, which was almost three times higher. Meanwhile, Russia undermined the signing of an extended deal on the transit of Turkmen gas, set to expire in late 2005. The dispute reached its apex on 1 January 2006, when Russia shut down all gas supplies passing through Ukrainian territory.

By taking advantage of Russia-Ukraine gas squabble, the Kremlin made Kiev both accept the increase in gas tariffs, to some $230 per 1,000 cubic meters –– while resuming Turkmen energy supplies to Ukraine ($44 per 1,000 cubic meters) and give the green light to establish RosUkrEnerg (RUE), a new company that became the intermediary between Russian Gazprom and Ukrainian Naftogaz. It aimed to lobby Russian interests in Ukraine. And suffice it to say, Russian Gazprom held half of the firm’s voting rights while a 45-percent stake was controlled by a pro-Russian billionaire oligarch Dmytro Firtash, as was the case of Poland’s EuRoPol Gas and Aleksander Gudzowaty, a Polish businessman. Also, one of the RosUkrEnergo’s executive directors was a fellow student of Dmitry Medvedev at the KGB academy.

The year 2009 saw yet another chapter of the Russian-Ukraine gas fight. Back then, Russia forced Ukraine to ink an unfavorable agreement on supplying and shipping gas and conclude a “fleet-for-gas” deal that allowed Russia to build up its military presence in Crimea. Although Russian and Ukrainian representatives first spoke to fix the price at $205–235 per 1,000 cubic meters, the Russian Federation upped its demand to $450 per 1,000 cubic meters, or nearly twice as much. In consequence, Moscow halted all deliveries to Ukraine and then to Europe. In the aftermath of the 2009 gas fight, some Central and Eastern European countries reported precipitous drops in gas pressure in their pipelines, with Slovakia being most affected. The government had to declare a state of emergency when a shortage of gas threatened the domestic industry.

Facing pressure from European countries, Ukraine struck a deal with Russia, agreeing to pay $450 for 1,000 cubic meters of Russian-sourced gas, with the basic price correlated to sulfur oil (mazut) prices under the take-or-pay formula and with no intermediaries. Kiev was forced to claim 33 billion cubic meters of gas, regardless of whether it got it or not, with no possibility to reexport extra volumes any further. In consequence, Ukraine paid one of Europe’s highest rates for Russian natural gas supplies, though, due to its geographic proximity, it was the first recipient on the route for Russian gas to Europe.

Russian gas prices for Ukraine did not drop until pro-Russian Viktor Yanukovych took office as the president of Ukraine in 2010. Under a “fleet-for-gas” deal signed, Ukraine allowed the Russian Black Sea fleet to stay in Crimea until 2042 , in exchange for Kiev receiving a 30 percent discount on Russian gas imports, by a maximum of $100.

Nord Stream

The policy, though allowing Moscow to exert pressure on Ukraine, had damaging consequences for the Russian Federation. A threat of Russia’s cutting off its gas supplies to the European Union decreased Moscow’s credibility as a supplier of raw materials, as best exemplified by Slovakia’s state of emergency. With this could come the gradual reduction in dependence on Russian-sourced energy not only in Poland, but also across Europe, including Germany, or the biggest recipient of Russian gas, accounting for 29.14 percent of Gazprom’s exports in 2018 .

Russian decision-makers said this gave rise to Russia’s unfavorable dependence on shipping its gas flows through Ukraine. Russian Ministry of Energy decided back in the 1990s to build an alternative transmission line to make sure its exports still flow to Germany, Moscow’s top European gas consumer, regardless of the situation in Ukraine. There emerged the idea to construct the North European Gas Pipeline, officially renamed Nord Stream sometime later.

Russia put in place all possible diplomatic means –– as well as those beyond classical diplomacy –– to complete the construction of the pipeline. The country long pushed back against critical opinions over the project’s feeble profitability, with Gerhard Schroeder, a former German chancellor, doing much of the work within the European Union. He inked the Russian-German deal only two weeks before being relieved from his political duties and assuming the position of the chairman of the Nord Stream supervisory board.

Russia applied a similar mechanism of political corruption in Finland. Nord Stream AG hired former Finnish prime minister Paavo Lipponen, who was in office while Nord Stream was under construction. The newly developed pipeline opened up the Russian market to Danish companies, including Carlsberg and LEGO, a move that empowered the position of Denmark’s Prime Minister Lars Løkke Rasmussen, who took office shortly before. In consequence, Russia had no problem obtaining permits for the construction of the new Baltic Sea pipeline running along the bottom of the Baltic Sea.

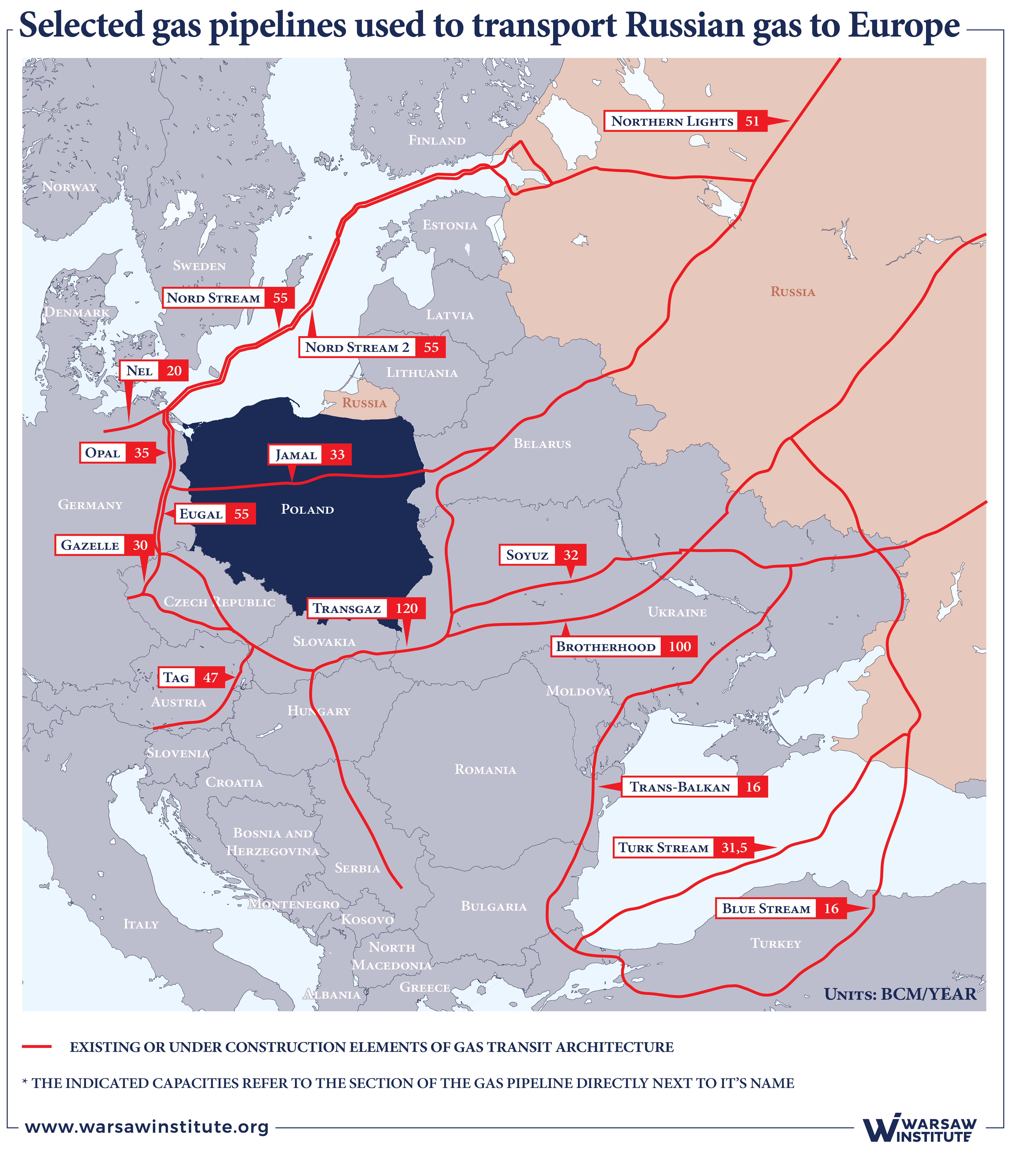

Gas flows through Nord Stream were initially intended to reach Germany, albeit with Austria’s Baumgarten gas hub (CEGH) as the leading destination for Russian gas supplies. This is the terminus for Russian gas shipments passing through Ukraine. What served as an onshore transit link pipeline was the OPAL pipeline, or a string running along the German-Polish border to connect Nord Stream with the Austrian gas hub. The gas infrastructure laid the technical groundwork for a shift in the European gas transmission system, enabling gas to be delivered via the Baltic route, the OPAL pipeline and the CEGH.

The first branch of Nord Stream became operational on November 8, 2011, while gas flows through the second leg began on October 8, 2012. Combined, the pipelines had the annual capacity to pump a total of 55 billion cubic meters of gas. The commissioning of Nord Stream coincided with Berlin’s much-anticipated decision to pull out of nuclear power and adopt renewable energy sources, with gas as a transitional fuel. Russian authorities yet again decided to boost the possibility of using the new gas trunkline for their political objectives. The capacity of 55 billion cubic meters was yet far too much for commercial purposes. Suffice it to note that the capacity of Ukraine’s gas transmission system was not used to its fullest potential. Furthermore, since 2009, Gazprom had failed to stick to the transit agreement that provided for shipping 110 billion cubic meters per year. This level was yet not met ever since.

But the purely economic reasoning attributed to the project did not perform a predominant role, though. As was the case of gas infrastructure developed back in the Soviet era and later, in the 1990s, Moscow sought to accomplish some political objectives. Thus, work started on a twin pipeline ahead of the official launch of Nord Stream 1.

Nord Stream 2

The year 2011 saw plans to expand Nord Stream by the two further strings in a bid to create a pipeline of the same capacity as Nord Stream. The new pipeline will double the amount of gas being funneled through the Baltic Sea to 110 billion cubic meters per year. Just to compare, Poland’s annual demand for gas is roughly 18 billion cubic meters.

In 2015 , the pipeline’s economic appropriateness gave rise to questions about the project’s further development, with half of Nord Stream 1’s potential left undeveloped. But what was said about the increase in blue fuel trade in Europe appeared to be accurate and further work on Nord Stream 2 could eventually gather steam.

Despite this, these are not only foreign commentators that put the project’s profitability into question. Russian Sberbank CIB’s analysts said Gazprom’s capital investments in these projects are unlikely to turn a profit within the next 20 years, even if the pipeline uses 60 percent of its total capabilities. The TurkStream and Power of Siberia gas trunklines, or Gazprom’s largest gas pipeline projects, were described as even less profitable. The authors of the report, which were laid off shortly after its publication, said in a paper that such low profitability raises questions as to whether it is proper to pump money into the Russian gas firm.

Source: ukranews.com

Source: ukranews.comSometime later, Poland’s anti-monopoly body UOKiK voiced criticism over the energy pipeline project. In 2016, UOKiK said the Nord Stream 2 project would undermine competition and rejected a planned joint venture tasked with building and operating the gas pipeline. Nord Stream 2’s investors, which are companies like Gazprom, Engie, Uniper, OMV, Shell and Wintershall, circumvented any objections filed by the Polish anti-monopoly office by establishing the Nord Stream AG operating company, or Gazprom subsidiary firm, that secured loans from the businesses involved in the project. Poland’s anti-monopoly watchdog is still probing into the matter.

Over the years that followed, there has emerged a clear-cut list of proponents of the project and those who spoke against the pipeline. As for the former countries, these are mostly Russia, Germany and Austria that reap most benefits from Europe’s upgraded gas pipeline architecture. On the other side of the barricade are countries like Poland, Ukraine, the Baltic and the United States, all of which might lose most if a new gas transmission line passes through the Baltic Sea.

The German government has over the past years made active efforts to uphold the idea, saying the implementation of Nord Stream 2 was based on purely economic and not political grounds. Meanwhile, Germany’s senior officials pressed ahead with some positive rulings pertaining to the energy project within the European Union, mostly as far as the EU gas directive was concerned. The paper aimed to apply EU-wide standards concerning the Nord Stream 2 offshore gas pipeline. Once amended, the document will enable the newest energy pipeline to use no more than 50 percent of its total transmission capacities.

France and Germany have struck a compromise allowing Berlin to see the revised EU directive to cover nothing but a section of the gas pipeline running through German territorial waters. To eliminate the need to implement any solutions that could be a hurdle to Gazprom’s solution, German lawmakers passed legal changes to ease completion of the pipeline by removing the date of commissioning of the project, a step that could exempt Nord Stream from the revised EU directive.

To delay further work on Nord Stream 2, Poland and Denmark decided to bear the brunt of taking additional steps. Both countries agreed to divide an exclusive economic zone, until then a disputed border between Poland and Denmark’s territorial waters in a move that forced Nord Stream 2 AG to submit an alternative route of the proposed gas pipeline. Copenhagen had a couple of legal tools for delaying the completion of the Russian-German energy project. At the time of the publication of the following paper, construction work could be completed no sooner than in mid-May 2020, which is in line with legal solutions adopted thus far.

The Republic of Poland challenged a European Commission decision that allowed the OPAL pipeline to be exempted from the third-party access (TPA) and tariff regulations. Warsaw had taken successful legal action, as a result of which the European Court of Justice overruled the European Commission decision that approved Russia’s Gazprom gaining full capacity on the OPAL gas pipeline. In consequence, the twin pipelines’ full transmission capacity of 110 billion cubic meters has been brought to a halt, at least temporarily.

This does not pertain to the EUGAL pipeline, Nord Stream 2’s onshore extension. The gas trunkline has not been exempted from EU-made principles, with most of its capacity reserved in an open auction process, which paved the way for almost full use of Nord Stream 2’s capacity.

New gas pipeline geopolitics

Much like in the case of its sister, Nord Stream 2 is being built to make Russia independent of its gas flows passing through Ukraine, while Europe declares a higher demand for blue fuel. The 2006 and 2009 gas crises made top Russian officials aware of such a solution to maintain its management-by-crisis policy throughout the region, albeit with no impediments to the Russian economy, which could manifest themselves through a decrease in energy exports to Europe.

This gave rise to Moscow’s plan to bypass Ukraine that could be likely to achieve through Russia’s development of its three energy trunklines – Nord Stream, Nord Stream 2 and South Stream, the last of which was replaced by an alternative TurkStream project. What Moscow intends to do is to remodel gas transmission infrastructure for its energy supplies across Europe . With new projects being launched, Russian transmission lines would rely on the three pipelines and the Central European Gas Hub. Hence, countries like Poland, the Czech Republic, Slovakia and Ukraine would have no other choice but to import gas from the west and not the east, with transit fees paid to Germany and Austria. These two, in their turn, would reap substantial profits in exchange for political favor towards Russia.

This is what Georg Zachmann, an expert at the Bruegel Institute think tank, told a conference on Nord Stream 2 in Brussels. His presentation encompassed an analysis of Russian natural gas flows in 2014 and how these could potentially change after Nord Stream 2 becomes operational.

In 2014, European customers bought 152 billion cubic meters of gas that reached their territories through Ukraine, the Baltics (via Nord Stream) and Belarus. These were 63, 38 and 36 billion cubic meters, respectively. But what is of utmost importance is where gas volumes are sent. The route passing Ukraine meets the gas needs of Ukraine while accounting for all Russian imports to the Balkans, Hungary, Slovakia, Romania, roughly half of Russian-sourced energy imports to Austria and the Czech Republic and some 30 percent of Russian gas flows to Italy. Some of the gas shipments flowing through Ukraine used to reach Germany too.

This stemmed from the commissioning of Nord Stream as the pipeline ousted gas volumes running through Ukraine from the Western European energy market, with particular focus on those of the Czech Republic and Austria that would claim Russian-sourced gas passing exclusively through Ukrainian territory. The OPAL gas connector, which allows distributing gas running via Nord Stream 2 further into mainland Europe, is poised to fulfill a major role in this respect. Germany is a leading recipient of gas flows running through Nord Stream.

Last but not least, gas transit through Ukraine accounts for 100 percent of Poland’s and a third of Germany’s energy imports from Russia.

Under a moderate scenario, Nord Stream 2 will become operational while the Baltic direction could morph into a top export corridor. As much as 110 billion cubic meters of Russian gas could be delivered to Western Europe provided that the OPAL gas pipeline is derogated from EU regulations. Through the existing and upgraded gas connections Russia would be capable of pushing gas passing through Ukraine from the energy markets in Germany, Italy, Austria, the Czech Republic, Slovakia, Hungary and Ukraine. This will be impossible to satisfy the needs of both the Balkan and Romanian markets, though in his analysis, Zachmann did not take into account the launch of the TurkStream energy pipeline. Once commissioned, it could no longer admit gas shipped through Ukrainian territory to the Balkans. Moldova would remain the only country to get its energy supplies through Ukraine due to a set of infrastructural constraints.

There is also a radical scenario – using Nord Stream and Nord Stream 2 to meet Europe’s current needs for Russian imports. In his paper, Zachmann noted that due to some restraint in the gas transmission network, it is unlike to pump more than 110 billion cubic meters of natural gas from the Baltics to Central and Eastern Europe and to the Balkans, a step that could run the risk of gas supply interruptions. Zachmann’s analysis does not, however, take into account new import opportunities to Poland from outside Russia coming into being of Turk Stream. This is especially that the Kremlin sees the latter investments as a vital element to meet the Balkans’ demand for Russian-sourced energy without the need to increase gas flows through Ukrainian territory.

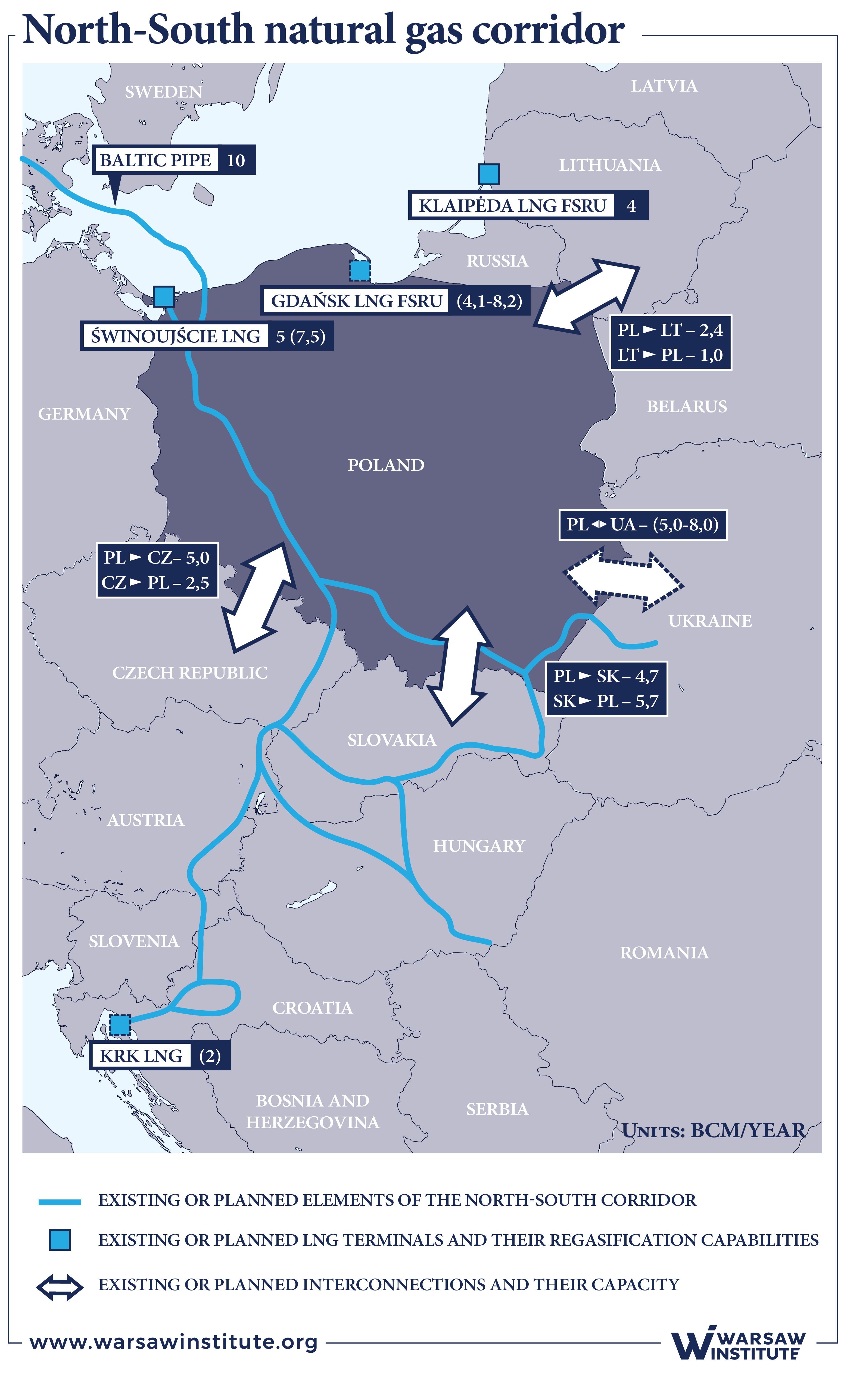

It is worthwhile mentioning that while Poland is building alternative supply routes, among which are the LNG terminal in Świnoujście, the Baltic Pipe from Norway and a floating storage and regasification unit in Gdansk Bay, to secure itself against a potential threat posed by a radical scenario, the halting of gas flows through the country could deprive the state of the current transit fees to the benefit of Germany. It is highly likely that if Poland reports a bigger demand for gas, a decision would be made to purchase further volumes on the European stock exchange, all of which came through the Baltic transmission corridor.

What represents yet another risk for Poland stems from the possibility to ship gas to neighboring countries, either as part of the trade in raw materials or intervention measures. Should the gas transmission route be shifted from Poland to the Baltics, Germany would be able to trade cheap Russian-sourced raw material, especially that Berlin buys gas at preferential rates. With such conditions, Poland’s energy could prove not at all competitive in terms of price.

Common interest

It is in the interest of all Central and Eastern European countries as well as the Balkans to counteract Russian initiatives so as not to make Nord Stream 2 and TurkStream pipeline’s in full swing before the region devises a strategy to combat adverse effects of cutting off transits services through Poland and Ukraine and to become independent of solely Russian-sourced energy.

There had been little leverage to prevent the Nord Stream 2 gas pipeline project from being completed, yet it may launch no sooner than in May 2020 due to holdback. But delaying plans to bypass transit through Ukrainian territory is not an end in itself. Poland and Denmark are pressing ahead with construction work to set the Baltic Pipeline fully operational by October 2022. Furthermore, Poland plans to expand the Świnoujście terminal’s capacity from 5 to 7.5 billion cubic meters per annum and to build an FSRU terminal in Gdańsk Bay. What Poland is doing right now seeks to prevent Poland from being cut off gas flows in consequence of Warsaw’s intention not to extend its long-term deal on gas supplies when it expires after 2022. On November 15, 2019, Poland’s PGNiG notified Russia’s Gazprom of its intent to terminate the Yamal agreement.

Russia pushed its gas pressure mechanism also in relation to Poland, with the latest gas interruptions taking place in 2016 and 2017. Incidentally, these coincided with the NATO summit in Warsaw and the visit of U.S. President Donald Trump to Poland. As Poland saw interruption in gas supplies, Russia redirected its gas flows through Nord Stream 1 while flashing the possibility to bypass Poland once the Kremlin considered the country’s policy unacceptable.

Moreover, Poland and Croatia joined efforts to build the North-South Gas Corridor to connect the LNG Terminal in Świnoujście with an LNG facility located on the Croatian island of Krk, as part of the Three Seas Initiative. Further steps are being taken to develop gas connections that will connect the Polish and Lithuanian gas transmission systems, currently known as GIPL, or those between Poland and the Czech Republic. A Poland-Ukraine gas interconnection is planned as well.

As a result of the change in the gas distribution route, Poland’s gas transmission system needed to be rebuilt to make it adaptable to the north-south and west-east axes. Poland’s gas transmission system has for years been adjusted to both transport and distribution of raw materials supplies flowing from the east. What is of utmost importance is the extension of the Tworzeń – Pogórska Wola pipeline, or Poland’s internal transmission bottleneck that hinders the full use of the capacity of the Poland-Ukraine gas interconnector to send gas volumes to Ukraine.

All the projects as listed above are underway, except for the FSRU terminal in Gdańsk Bay, and set to become operational by 2022 when the Polish-Russian gas agreement expires.

Conclusions

The author of the following paper believes that Poland’s complete pullout of importing extra gas volumes from Russia is yet not an optimal solution. What deems the most desirable scenario is to add Russian-sourced gas flows to the energy purchasing portfolio of Poland’s state-run gas company PGNiG that encompasses raw materials from Norway, the United States and Qatar as well as spot purchases. It is also advisable to maintain gas transit from Russia to Germany. Notwithstanding these, the terms of the gas deal must change as they bring no profits to Poland.

LNG Terminal in Swinoujscie, Poland. Source: PGNiG

LNG Terminal in Swinoujscie, Poland. Source: PGNiGTo achieve the possibility of extending the transit contract, albeit on favorable terms, it is necessary to prevent Russia from becoming independent of gas flows passing through Poland, chiefly by making full use of the Nord Stream 2 and TurkStream pipelines. Poland has at its disposal a set of tools for reducing the volume of gas shipped via the Baltic Sea. Poland must monitor legal actions taken in relation to the OPAL and Nord Stream 2 gas pipelines. According to the revised EU directive, European Union regulations pertain to a section of the Nord Stream 2 pipeline running along German territorial waters. This paves the way for lodging a complaint to the Court of Justice of the European Union to reduce how much gas will be shipped through the trunkline. Nonetheless, Berlin’s attempts to selectively implement the provisions of the revised EU gas directive that could exempt Nord Stream 2 from these regulations are somewhat worrying.

It is worthwhile noting what consequences would follow from bypassing Ukraine as a transit country. The East European country does not develop its gas diversification projects to a satisfactory extent. Ukraine imports as much as 10 billion cubic meters of gas, which is a third of the state’s overall energy consumption. The country’s recent drop in energy consumption stems chiefly from the loss of part of its territory, while its increased energy efficiency accounts for a slight part of it. This offers a great deal of potential though recent years are unlike to see a massive drop in gas consumption in Ukraine yet to bring a stable tendency.

Ukraine’s current diversification plans rely on stimulating state-owned gas firms to boost output. The country’s domestic reserves are depleted to a considerable extent that in order to encourage production, gas companies would be forced to use the hydrofracturing technology on a mass scale, which is impossible without foreign investments. But investors’ confidence in Ukraine is undermined amidst the high level of corruption and oligarchization in the country. U.S. companies may feel deterred by the latest scandal around Hunter Biden, who held ties to Ukraine’s gas extraction industry.

In consequence, Ukraine has no other choice but to import raw materials from elsewhere, perhaps through interconnections running to Slovakia, Hungary and Poland. Gas connections with Poland and Romania are currently being expanded. Once gas flows could no longer pass through Ukraine, there will be no possibility to reverse energy supplies while any gas Ukraine imported would come from the Baltics, according to what Zachmann said. Such a solution would boost both costs and run the risk of potential supply disruptions. This gives Poland a greater room for increasing its share in the Ukrainian gas market, provided that gas transmission capacities are more extensive.

Attention should also be drawn to financial and technical aspects. Ukraine receives roughly 1% percent, or $3 billion, of its GDP from gas transit fees. Ukraine’s National Bank said direct economic losses compared with transit volumes at the current level would amount to 0.6 percent of GDP in 2020 and 0.9 percent of GDP in 2021 and further. Furthermore, Ukraine’s gas transmission and distribution network are interdependent, unlike the Polish branch of the Yamal pipeline, which is a separate trunkline. In consequence, an annual drop in gas transit below 30 billion cubic meters, from east to west, may imply supply interruptions in Ukraine’s central and eastern regions. Ukrainian Prime Minister Oleksiy Honcharuk, for his part, informed about a similar threat.

The Nord Stream 2 pipeline is expected to launch in mid-2020. The TurkStream pipeline will become operational as early as 2020 without any major hiccups. Little is known to what extent the Baltic pipeline will be filled with gas supplies, yet some say the trunkline could transport as much as 80 billion cubic meters gas per year. Russia is unlike to no longer ship gas through Ukraine and might opt for a minimum annual transit volume of 30 billion cubic meters per year. Thus far, Ukraine will lose some of its revenues from gas transit fees. Nothing is said about the outcomes for the Ukrainian gas distribution system, though.

What is likely to happen is to see Russia cutting off Ukraine from gas supplies, with gas shipments flowing further to the European Union, albeit through other routes. Moreover, Moscow could shut down gas transit via Poland, by diverting gas supplies through Nord Stream 2. This does not represent a major threat to Warsaw, due to marginal profits it gains from gas transit fees and thanks to Poland’s transmission pipeline being separated from the distribution network. Poland will inevitably lose some of its potential advantages it could reap by signing a way more favorable transit deal.

Nonetheless, Poland has a set of political tools at its disposal. First of all, Warsaw should monitor the implementation of the decision by the European Court of Justice (ECJ) to limit Gazprom’s use of the OPAL onshore pipeline and prevent the Russian gas firm from making full use of Nord Stream’s capacity. It is vital that Poland exert pressure on the European Commission to make the latter negatively assess the unfavorable directive that allows Nord Stream 2 to be exempted from its provisions.

In addition to adequate steps, it is of utmost importance to implement a series of diversification plans. Poland should make efforts to ensure the timely implementation of its Baltic Pipe energy project and boost the regasification capacity of its LNG terminal in Świnoujście. It seems reasonable to buy an FSRU terminal in Gdansk Bay and to make spot contracts an essential part of Poland’s energy purchasing portfolio to operate without long-term contracts, mainly with the United States. Last but not least, attempts should be made to expand gas interconnectors throughout the region and back Croatia’s efforts to build the Krk gas terminal to enhance flexibility on the gas market in Central and Eastern Europe. Such an approach might pave the way for becoming independent of the use of gas for political purposes while ensuring lower energy prices and higher competitiveness on the gas market.

Author:

Maciej Zaniewicz – an editor of energetyka24.com, a website devoted to the energy policy in the countries of the former Soviet Union. In the past, he served as editor-in-chief of eastbook.eu, a site on Eastern Europe. His articles appeared in journals like Nowa Europa Wschodnia and New Eastern Europe, as well as the Dziennik Gazeta Prawna daily. A graduate of the Centre for East European Studies at the University of Warsaw.

The publication of the Special Report was co-financed from the funds of the Civic Initiatives Fund Program 2018.

The concept of analytical material was created thanks to co-financing from the Civil Society Organisations Development Programme 2019.

Selected activities of our institution are supported in cooperation with The National Freedom Institute – Centre for Civil Society Development.

Wszystkie teksty (bez zdjęć) publikowane przez Fundacje Warsaw Institute mogą być rozpowszechniane pod warunkiem podania ich źródła.