RUSSIA MONITOR

Date: 30 May 2020

Gazprom Is Turning Towards China, But There Are Problems

With the gloomy prospects for the European gas market, Gazprom is making efforts to send more energy eastwards. The Power of Siberia 2 gas link, a second gas pipeline to China that Russia has just begun to construct, will link the Yamal Peninsula, which holds the country’s biggest proven gas reserves, and China. The Yamal Peninsula already feeds Gazprom’s customers across Europe. Nonetheless, Moscow might have expected its cooperation with China to look differently. Beijing is keen to buy more gas from Russia, yet it is wary of subsidizing Gazprom’s fresh energy projects.

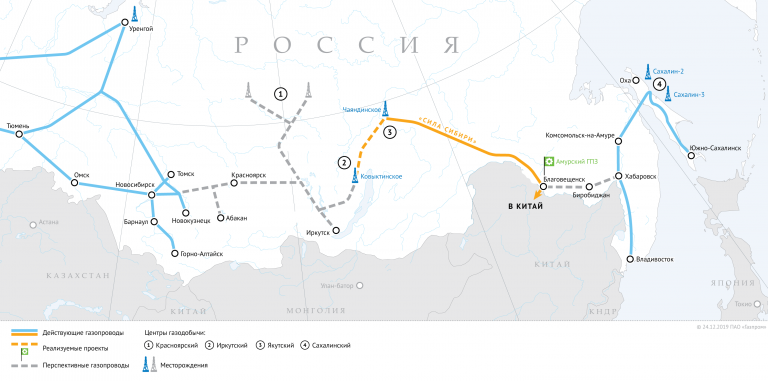

The Russian energy behemoth has launched works to build its Russia-to-China Power of Siberia 2 energy link, or the Altai gas pipeline. At his meeting with the head of Gazprom in late March, Vladimir Putin gave his go-ahead for the implementation of the project. Gazprom CEO Alexei Miller said on May 18 it had launched feasibility studies for the construction of a second gas pipeline to China. The new energy link is officially slated to connect Russia’s gas infrastructure in the country’s west and east as well as bring gas into the eastern parts of Siberia. The pipeline might pass through Mongolia, Miller said, and it might carry up to 50 billion cubic meters of natural gas per year to China. “Gas from Russia’s Yamal will reach both Europe and Asia,” he added. Russian energy majors are looking to send more commodities to China’s burgeoning market. By 2030, China might import up to 600 bcm of natural gas per year to meet its domestic needs.

In 2015, Gazprom and China National Petroleum Corporation (CNPC) inked a letter of intent on delivering gas supplies from Western Siberian fields via a western route, or the Power of Siberia 2 link. Under the deal, the Russian gas company will build a brand-new gas pipeline system within the existing transport corridor from Western Siberia to Novosibirsk, and further to the Chinese border. With the Power of Siberia 2 pipeline, Russia could double its gas deliveries into China. In December 2019, Gazprom started pumping gas to southeastern China via its Power of Siberia pipeline. In 2014, the Russian gas firm signed a $400 billion contract with CNPC to supply 38 bcm per year through the Power of Siberia over 30 years. The Power of Siberia transports natural gas from Yakutia and Primorsky Krai to China. The 2,159-kilometer link would have an annual volume of up to 38 bcm of natural gas.

Support Us

If content prepared by Warsaw Institute team is useful for you, please support our actions. Donations from private persons are necessary for the continuation of our mission.

Notwithstanding that, Gazprom may find it challenging to provide enough gas to execute its recent contract with China. Its Chayanda field in Yakutia could hold less gas than the Russian major is poised to inject into the Power of Siberia pipeline. Due to some technology flaws, as many as 50 gas rigs are unable to be exploited as previously planned. Also, Gazprom is fighting an uphill battle while seeking to receive some external financing to build its energy projects, one of them being the Ust-Luga gas processing and LNG complex, worth some 750 billion roubles. Earlier it could not secure financing for new facilities of Amur gas processing plant. In early 2019, Gazprom was making efforts to encourage Chinese investors to enter the deal. China Development Bank (CDB), the country’s top policy lender, yet turned down the Russian offer.

All texts published by the Warsaw Institute Foundation may be disseminated on the condition that their origin is credited. Images may not be used without permission.