RUSSIA MONITOR

Date: 19 September 2019

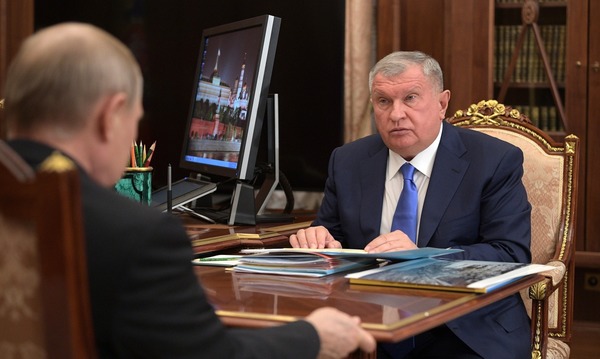

U.S. Warns Sechin’s Firm over Trading Venezuelan Oil

The activity of Russia’s state-run oil firm Rosneft on Venezuelan soil is a matter of mounting concern for the U.S. administration. U.S. Special Envoy for Venezuela Elliott Abrams said Washington could impose sanctions against Igor Sechin’s company over its alleged assistance for the Nicolas Maduro-led regime. Following the withdrawal of other oil importers from the Venezuelan market, Russia’s Rosneft is for Venezuela the last-ditch solution.

Afraid of violating U.S. restrictions, China National Petroleum Corporation (CNPC) refuses to import Venezuelan-sourced crude for the second month in a row. In August this year, CNPC, a leading buyer of Venezuelan oil, canceled plans to ship some 5 million barrels of crude. Earlier, in July, Venezuelan oil imports to China shrank by 40 percent to reach no more than 700,000 tons, hitting a five-year low. This stems from the U.S. sanctions imposed against Venezuela, a punitive measure that targets the country’s oil sector which is basically the sole source of income for the government in Caracas. Russia is taking advantage of the situation by offering help to the allied Maduro regime while gaining from re-exporting oil shipments and filling out an empty slot on the market. Recent months have seen Rosneft as the top trader of Venezuelan oil given that Caracas is grappling with the U.S. restrictions. In July, PDVSA and its partners exported a total of 932,000 barrels per day of crude mostly sent to Asian destinations, with Rosneft taking more than 46 percent of the country’s shipments.

Support Us

If content prepared by Warsaw Institute team is useful for you, please support our actions. Donations from private persons are necessary for the continuation of our mission.

Russia’s oil company is not afraid of breaching U.S. sanctions because it takes oil as part of debt servicing agreements. Starting from 2014, Rosneft helped the regime in Caracas by making huge prepayments for crude deliveries. PDVSA has debts to state-owned Rosneft of $6.5 billion. As of 2018, Venezuela’s PDVSA managed to repay part of its outstanding financial commitments to Russia, lowering its debts to some $2.3 billion. Formally, Venezuela records no incomes from trading oil shipments to Rosneft, because these stands as repayment for what remains as a debt. This is why the U.S. Department of State has not yet objected to these Russian-Venezuelan oil deals. But Washington’s patience seems to have reached its apex. The activity of Russia’s most prominent oil firm is less and less to the liking of the Trump administration that introduced punitive measures against Venezuela in the hope that this will economically topple the Maduro regime. “I think Rosneft makes a lot of money in Venezuela. I believe that they buy crude oil in Venezuela at a great discount, sell final products to them,” said Elliott Abrams. To put in bluntly, Washington is well aware of Moscow’s help for Venezuela, and considerable profits it makes. “Over this year, we have witnessed the growing reliance of Venezuela’s regime and PDVSA on both the Russian government and Rosneft. More and more Venezuelan oil is being sold to Rosneft. And Rosneft sells these supplies further. I believe that the relocation of the European office of Venezuelan state-run oil company PDVSA to Moscow may be viewed as a symbol of Venezuelan-Russian ties getting stronger,” US Special Representative for Venezuela Elliott Abrams was reported as saying. This can be considered the first major warning for Russia. Given that Rosneft will have no intention to drop its imports from Venezuela, Washington’s next step will be to take action and hit Moscow-Caracas oil alliance.

All texts published by the Warsaw Institute Foundation may be disseminated on the condition that their origin is credited. Images may not be used without permission.