OPINIONS

Date: 22 July 2022 Author: Finn-Ole Albers

Comparing Western and Russian arms exports to the Middle East and North Africa

As the war in Ukraine goes on, the tensions between Russia and the West could enter a new phase of geopolitical rivalry on a global level. One region of great importance both for the West and Russia are the countries of the Middle East and North Africa (MENA) and one area of contest are arms exports.

According to the German defence expert Christian Mölling, the political logic behind arms exports is to build stable political relationships between the exporting and the importing country: The importer does not just buy one single tank or fighter aircraft, but in many cases he depends on the exporter’s constant maintenance and supplies of spare-parts.[1]

Therefore, this article looks at the trends of arms exports to the MENA region and compares the volume of Russian, Chinese and Western exports from 2011 until 2021.

Collection of data

The data was collected from the SIPRI Arms Transfers Database.[2] The countries that are counted as part of the Middle East and North Africa are taken as well from SIPRI’s definition.[3]

Note that SIPRI measures arms transfers not in its financial value but in its military value (TIV: trend-indicator value).[4]

The tables combine Russia and Belarus (RUS+BEL) and the United States and Canada (USA+CAN). Australia, New Zealand and South Korea are summarized as Democratic Asia (Dem. Asia). Europe contains the EU, Norway, Switzerland, Ukraine and Georgia.

A large advantage for western states

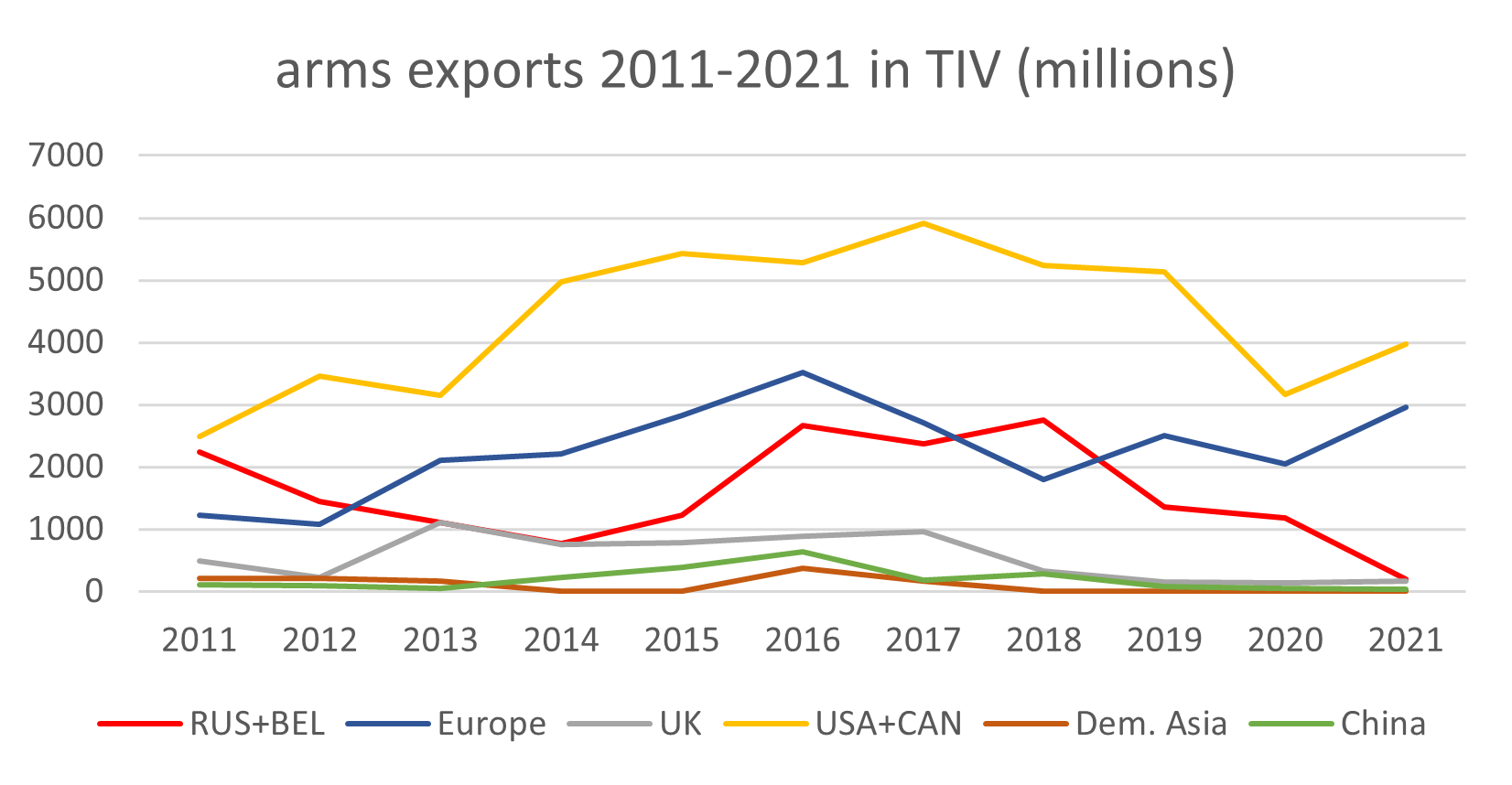

According to the data, the United States and Canada are the biggest exporters of arms. In 2011, its volume in TIV was 2483 million, it reached its maximum with 5919 in 2017 and decreased to 3979 million TIV in 2021.

This pattern can also be observed for Russia and Europe who had their maximum volumes in 2018 (2753 mio. TIV) and 2016 (3521 mio. TIV). Regarding Russia there is a remarkable decline in 2021, when it just exported arms valuing 192 mio. TIVs.

China just plays a minor role: In 2021 it just exported arms valuing 40 million TIVs, although it is looking out for opportunities to increase the volume in the future.[5]

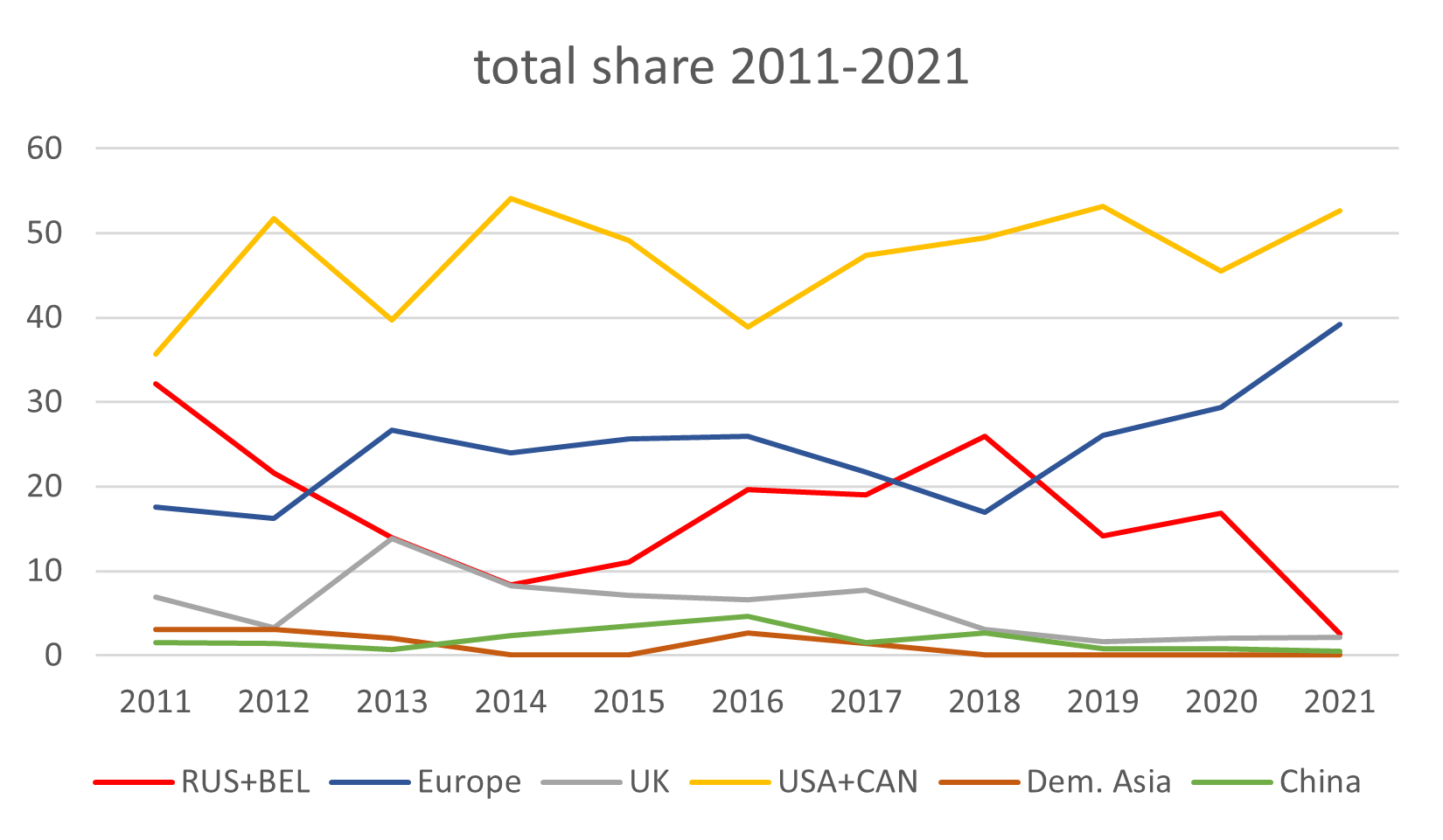

Taking the total annual share of the exporting countries into account, 40 to 50 percent of the arms are transferred by the United States and Canada. From 2018 to 2021 the European states increased their share from 16.9 to 39.2 percent. On the contrary Russian exports in 2021 amounted just 2.5 percent to all exports and Chinese exports amounted 0.53 percent.

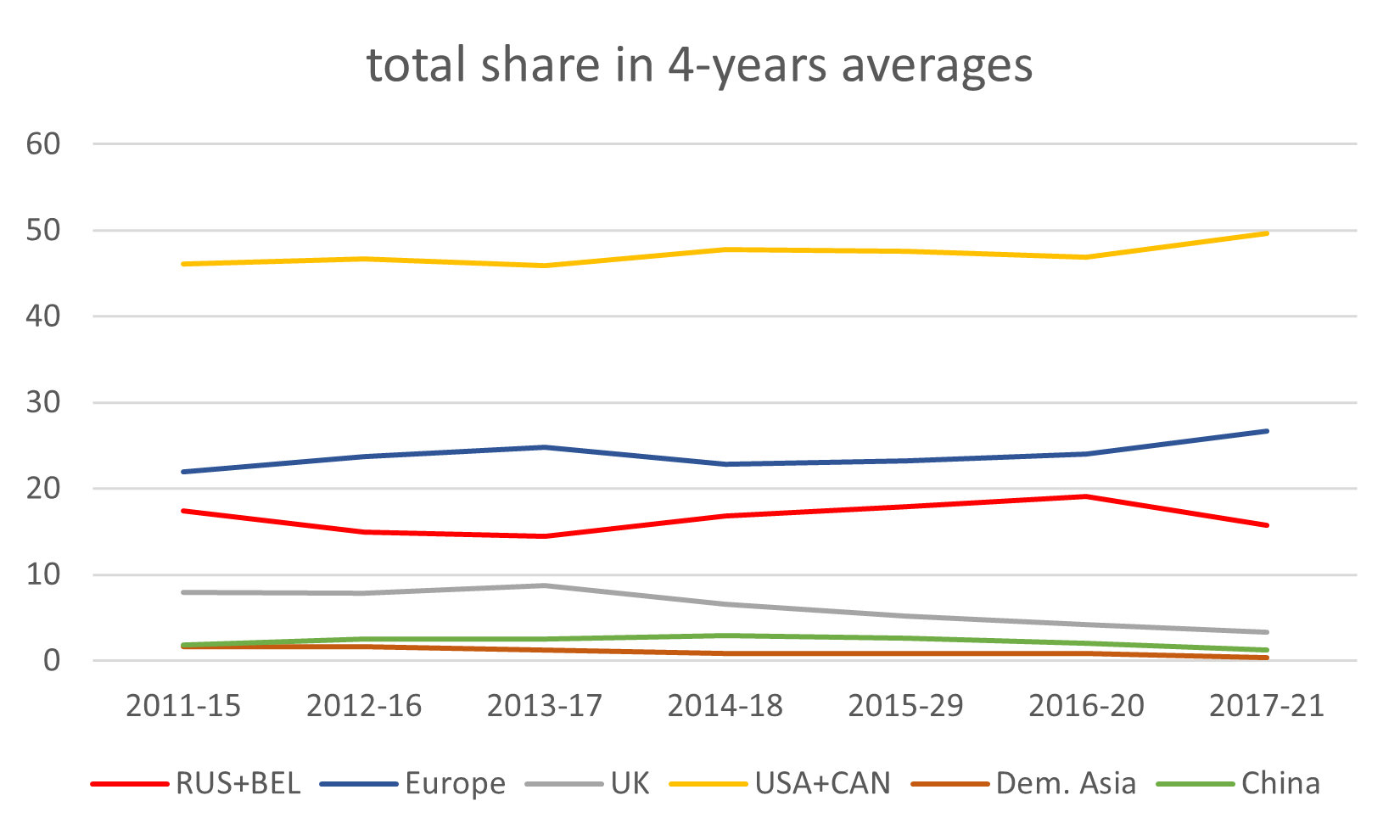

Considering the share in 4-years averages, Russian and Belarussian exports range between 14.1 and 19.1 percent.

Despite the low TIV-values in the last three years, it might be too early to make a definite statement on the decline of Russian exports and the rise of Western ones: In a linear regression model, there is a negative coefficient of -49.5 per unit for Russia and there are positive coefficients for Europe (116.4) and the US and Canada (121.0). However, the p-value for all of them is larger than 0.05 which makes the results not significant (0.55 for Russia, 0.10 for Europe and 0.30 for North America).

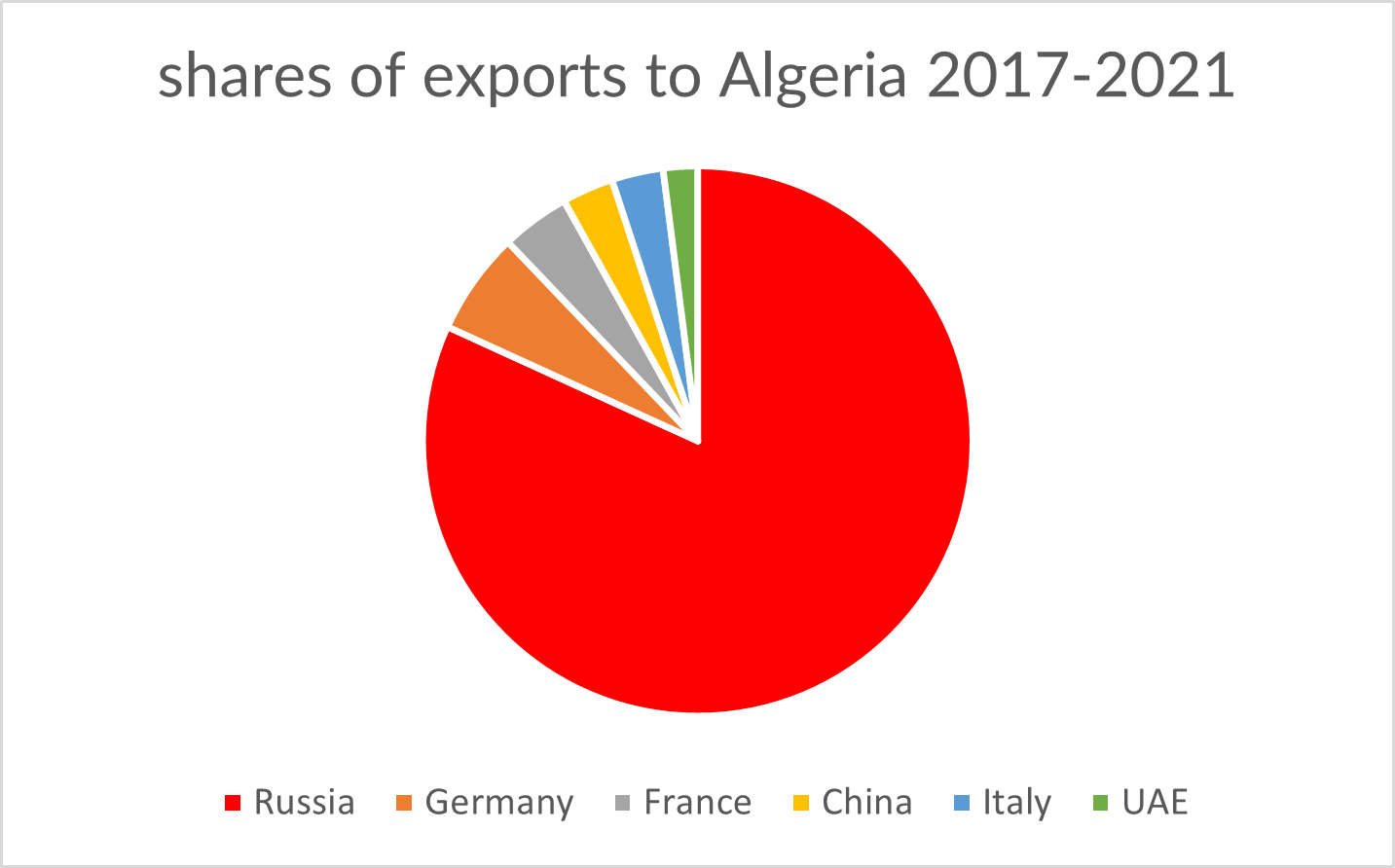

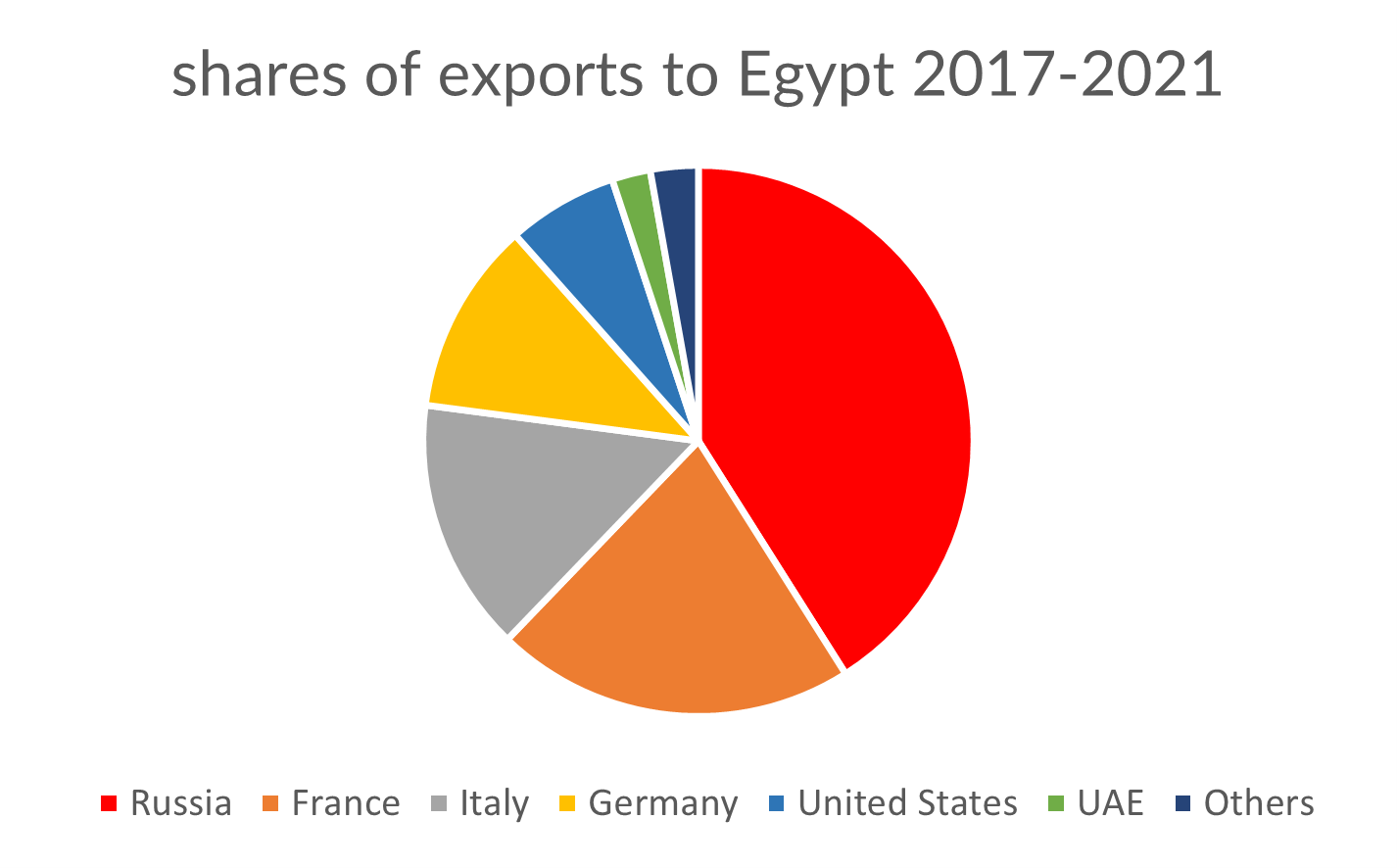

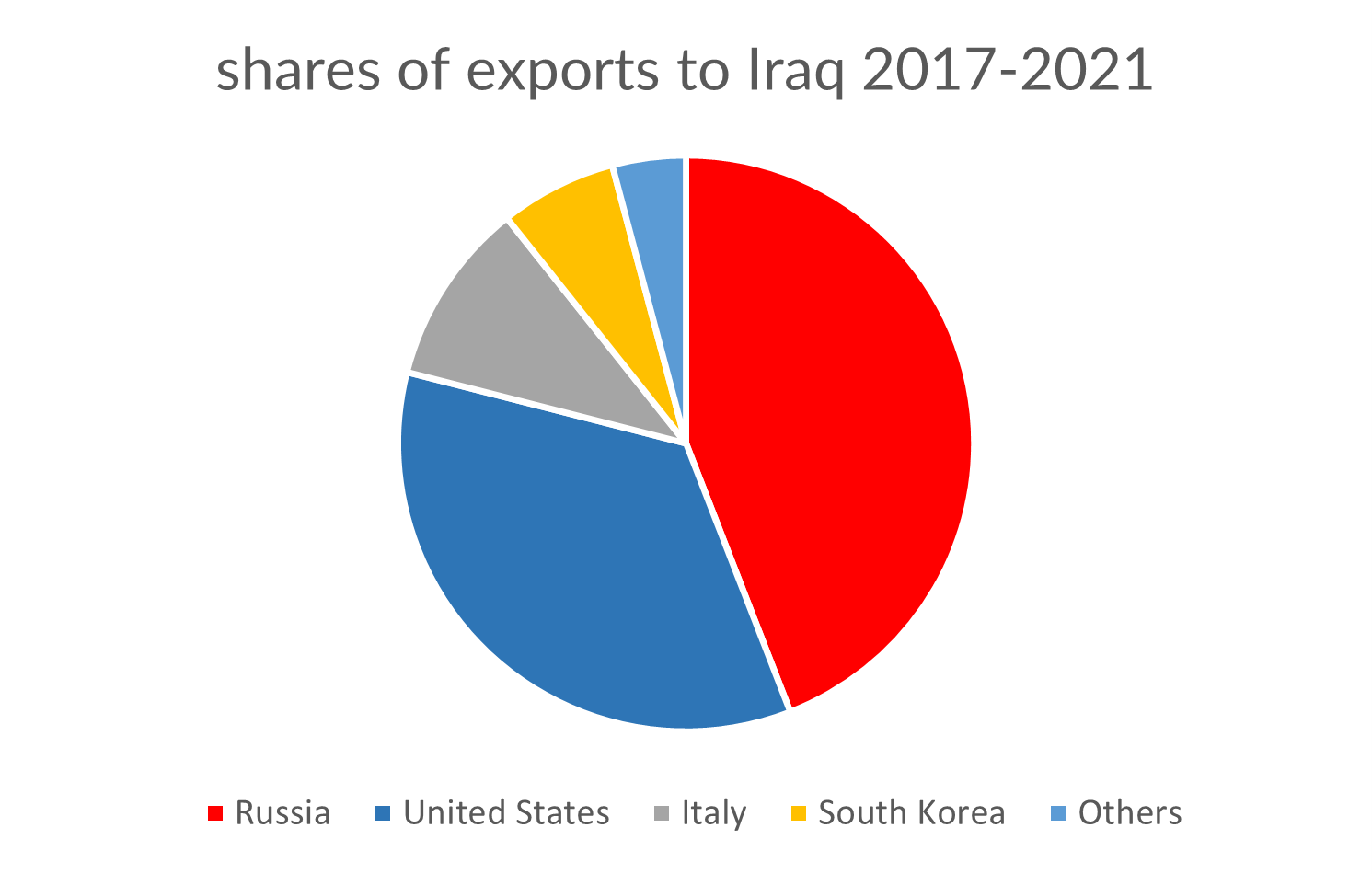

There are three countries where Russia was the largest supplier in the period 2017 to 2021: Russia’s share in Algeria was 81 percent, in Iraq it was 44 percent and 41 percent in Egypt.

However, the war in Ukraine could have a negative impact on Russian exports in the future. In his article, Sean Mathews cites several US government officials who state that the Russian supplies to costumers in the Middle East were severely constrained due to western financial sanctions, export controls and Russia’s strong engagement in Ukraine, which required the full attention of its armament industry.[6]

[1] Mölling, Christian: Für eine sicherheitspolitische Begründung deutscher Rüstungsexporte, November 2013 in https://www.swp-berlin.org/publications/products/aktuell/2013A66_mlg.pdf, p. 3.

[2] https://www.sipri.org/databases/armstransfers

[3] https://www.sipri.org/research/conflict-peace-and-security/middle-east-and-north-africa

[4] https://www.sipri.org/databases/armstransfers/sources-and-methods

[5] Ningthoujam, Alvite: The Middle East: An Emerging Market for Chinese Arms Exports, 25. 06.2021, in: https://thediplomat.com/2021/06/the-middle-east-an-emerging-market-for-chinese-arms-exports/

[6] Mathews, Sean: Moscow’s quest for Middle East arms deals upended by fighting, 28.03.2022, in: https://www.middleeasteye.net/news/russia-ukraine-war-arms-sales-middle-east-upended-experts-say

Support Us

If content prepared by Warsaw Institute team is useful for you, please support our actions. Donations from private persons are necessary for the continuation of our mission.

_________________________________

All texts published by the Warsaw Institute Foundation may be disseminated on the condition that their origin is credited. Images may not be used without permission.