NEWS

Date: 5 January 2019

Energy Security: Determining Factors in the Ever–Evolving Perception of the Problem

Comment given by Professor Piotr Kwiatkiewicz for the Warsaw Institute on energy security, the history of this phenomenon, its determinants and historical and geopolitical conditions.

The notion of „energy security” can be considered a signum temporis of our time. Moreover, with its ever-growing importance, it has emerged as one of the world’s most serious concerns.

In the decade following the end of World War II, the ability to deliver both raw materials and fuels in quantities that satisfied internal consumption demand in a given country could justifiably be considered as signs of prosperity as well as stability especially in war-torn Europe – still rebuilding after the war. In a much broader sense, the psychological significance of society’s energy security was most evident in the late 1940, during the so-called Berlin crisis, when the Soviet blockade cut off land access to the city’s western occupation zones, which meant that the only way the inhabitants of these zones could access necessary goods was through frequent airlifts.

At that time, coal became a vital necessity, as evidenced by the fact that it was the most transported community by tonnage weight and although considerable stocks had been accumulated previously, its delivery was still considered an absolute priority. Therefore, it turned out to be no less important than hygiene products and food supplies. During the Easter Parade operation, conducted on April 15, 1949, nearly 13,000 tons were delivered within a 24 hour time frame. Although no other goods were transported at that time, this was still a very formidable achievement. The action of limiting the assortment to just one resource exhibited its significance and highlighted the magnitude of such a practical and utilitarian undertaking. It was referred to as a kind of logistical test, the final results of which were reportedly used to eliminate all existing flaws in the delivery method. Similarly, additional measures were implemented to boost supply efficiency, which turned out to be a success. By April 15, an average daily volume of volume 6,700 tons was delivered which increased considerably to an average daily rate of 8,900 tones after April 16, 1949. The overall quantities of coal transported to Berlin’s Allied-occupied zones, were so impressive that they might even arouse bewilderment especially when considering the restrictions regarding raw materials usage for heating purposes. In addition, the Zschornewitz Power Plant, the powerplant responsible for powering the majority of the city prior to the war, was not operational due to the war. As a result, the city experienced frequent blackouts. These blackouts became as symbolic as the airlifts themselves. However, this troublesome lack of electricity was not unrelated to the demand for coal. Both the amount of raw materials transported by air, as well as the consumption thereof, may be regarded as a kind of phenomenon since it was not the only energy supply to be delivered to the city. Naturally, it dominated most supplies in terms of its quantity and weight – giving way only to food products – but its quantity supplied was much greater than that of other fuels, including diesel, gasoline and engine oil. This meant that energy resources prevailed over goods and other products shipped to the blocked zone.

The need to guarantee supplies as well as the processing of those supplies became a crucial as a conceptual area within energy security in the 1950s and 1960s. Both the notion, as well as its understanding, had a solely intuitive dimension and never functioned in a formal way; if mentioned, it mostly fit in contexts of some far-reaching questions about the future of mankind and its further development.

Therefore, its nature was more abstract rather than utilitarian. Still, the very problem of providing fuels emerged mostly in the world’s most industrialized regions. Some of the factors that were conducive to the growth in demand and played a key role in solving supply problems was the historical closeness of the most developed economic and industrial centers. The issue of energy security was comparable to the supply of petroleum products while all other needs could have been satisfied thanks to local raw materials.

Coal’s dominance over other energy carriers lasted for more than a century and significantly impacted perception of energy security issues. These factors, including the wide geographic area of resource deposits as well as its fairly ubiquitous availability have aided in resolving the logistics issue for decades thereafter. These logistical salutation primarily consisted of the establishment of local gas plants, equipped with turbines, followed by power plants and thermal-electric power stations located in the immediate proximity of major transport nodes, especially near bodies of water and along rail lines. Bearing in mind the constant supply surplus and market competition, the mechanisms aimed at ensuring proper supplies were used solely to negotiate the best prices.

The existing order was disturbed due to the growing importance of hydrocarbon raw materials, the first changes of which were related to the dynamically growing demand for crude oil. Its products could be used to generate electricity, with the process taking place exclusively in mining areas or in countries with extensive natural resource reserves. Demand for these hydrocarbons was essentially created by transport, with particular regard to automotive transport.

Price factor – the 1973 oil crisis, the Shiite revolution and the Iran–Iraq War

A significant change occurred in 1973, which marked the beginning of „oil crisis”. The crisis was provoked by Arab oil producers who used U.S. support for Israel during the Yom Kippur War as a pretext to impose an export embargo on western countries. Nonetheless, contrary to popular opinion, the goal in inciting the oil crisis was to renegotiating concession agreements. In 1972, during the OPEC forum, the Arabs openly stipulated that importers should renegotiate all previously concluded contracts with exporters, even if that required implementing monetary devaluation measures. As such, they were not particularly interested in rates; instead, they fought to gain important shares in corporations while aiming to obtain exclusive rights to own the extracted raw materials. Corporations, which were in fact a party to the dispute, could find themselves in a slightly different position than the affected importing countries as their activity was not affected by price increases.

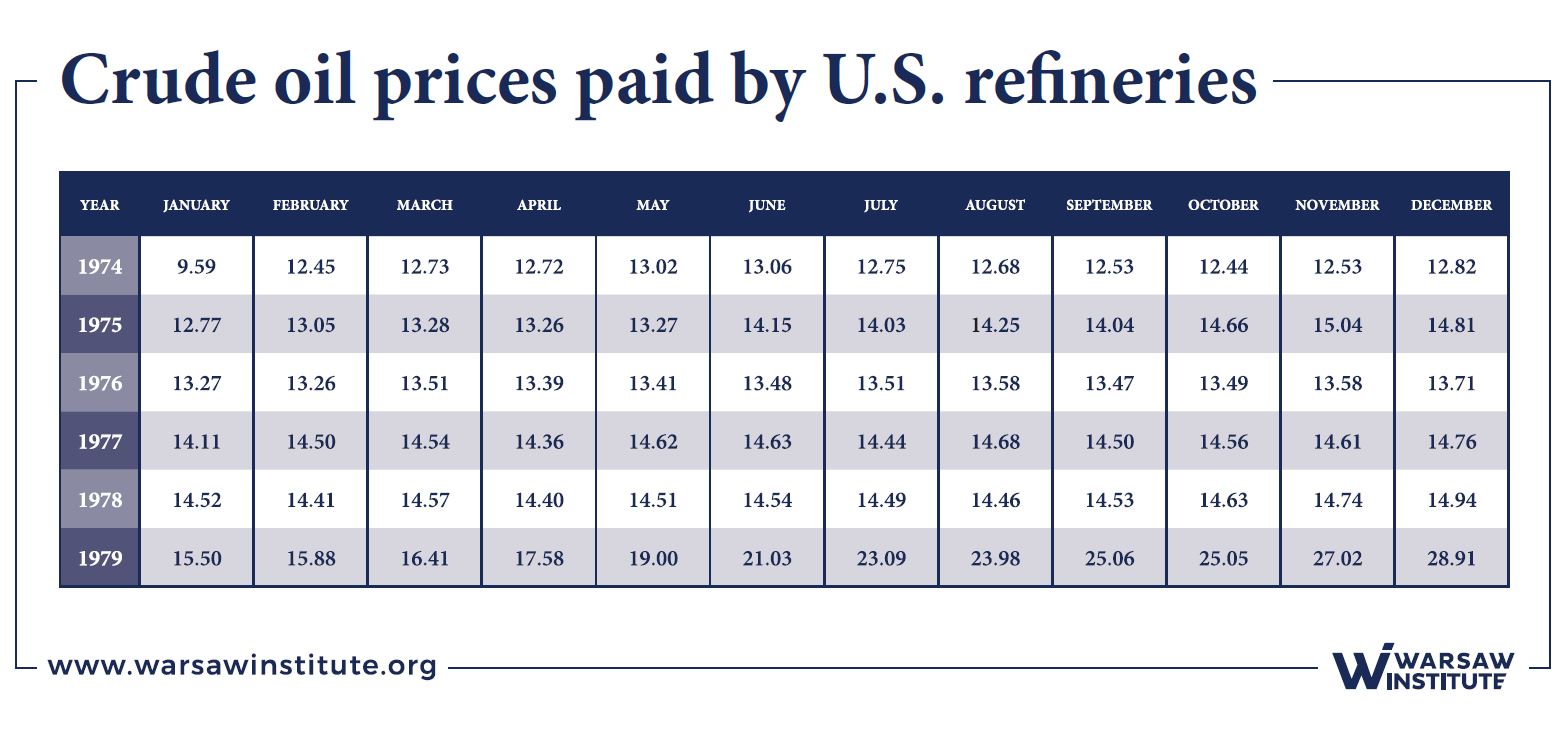

For the first time in history, U.S. citizens encountered numerous difficulties while refueling their vehicles due to the supply shock. However, the consequences of the situation had far reaching consequences beyond the initial supply shock. In other words, the supply shock was mitigated and abated while oil prices remained disproportionally higher compared to the period before 1973. Investor sentiment among market player also remained elevated due to anxiety over possible future supply problems and the subsequent increases in the fuel purchase prices.

These problems signaled the beginning of a real revolution in the automotive industry. The embargo brought smaller cars to American roads while the number of large and spacious vehicles drastically decreased . Such change in preferences appeared to be particularly noticeable on the old continent while in the United States this process moved at a significantly slower place and never reached the dynamics found in Europe. Nonetheless, it finally did occur, as evidenced by the rocketing popularity of Japanese vehicles, which, since the mid-1970, were effectively competing with U.S. full-size cars, often playfully referred to as „road cruisers”.

Any major changes in the buying habits of consumers in the automotive market should stem from the perceived fear of possible future market turbulence. Market sentiment greatly impacted both the political and economic climate of the 1970s. These changes were most evident in developed economies that relied on crude oil imports. Consumer sentiment was also greatly impacted by the media, which brought the oil crisis to the homes of Americans on a daily basis. These fears most prominently were exhibited in 1979 during the height of the political conflict with Iran, although market volatility remained high in the years between these two conflicts.

This state of anxiety, which continued for many years, affected economic security, mainly because of the economic significance of energy resource supplies. This awareness gradually began to form in oil producing countries as well, which were previously not affected by any supply shortages. As evidenced by the case of the United States, the need to minimize risk appeared much more important than the consequences of actions. Nonetheless, emphasis was put essentially on economic context. The perception of the price of refinery deliveries changed compared to previous decades when they were relatively stable and the amplitude of their fluctuations did not exceed more than a couple percent. This new image was shaped to a large extent by the media and pressures from public opinion.

The Shiite revolution and the Iran–Iraq War

Events such as the political turmoil in Iran, followed by the fall of the monarchy, gave rise to further increases in the price of crude oil on the stock market. It also contributed to the formulation of economic security as it relates to the supplies of energy raw materials, after the fuel crisis of the early 1970. Both their prices and guarantees of delivery became extremely important factors. Any political implications associated with the implementing of such an undertaking seemed to be relegated to the sidelines but not completely marginalized. This state of affairs was mainly caused by the long-standing competition between the world’s superpowers during the Cold War.

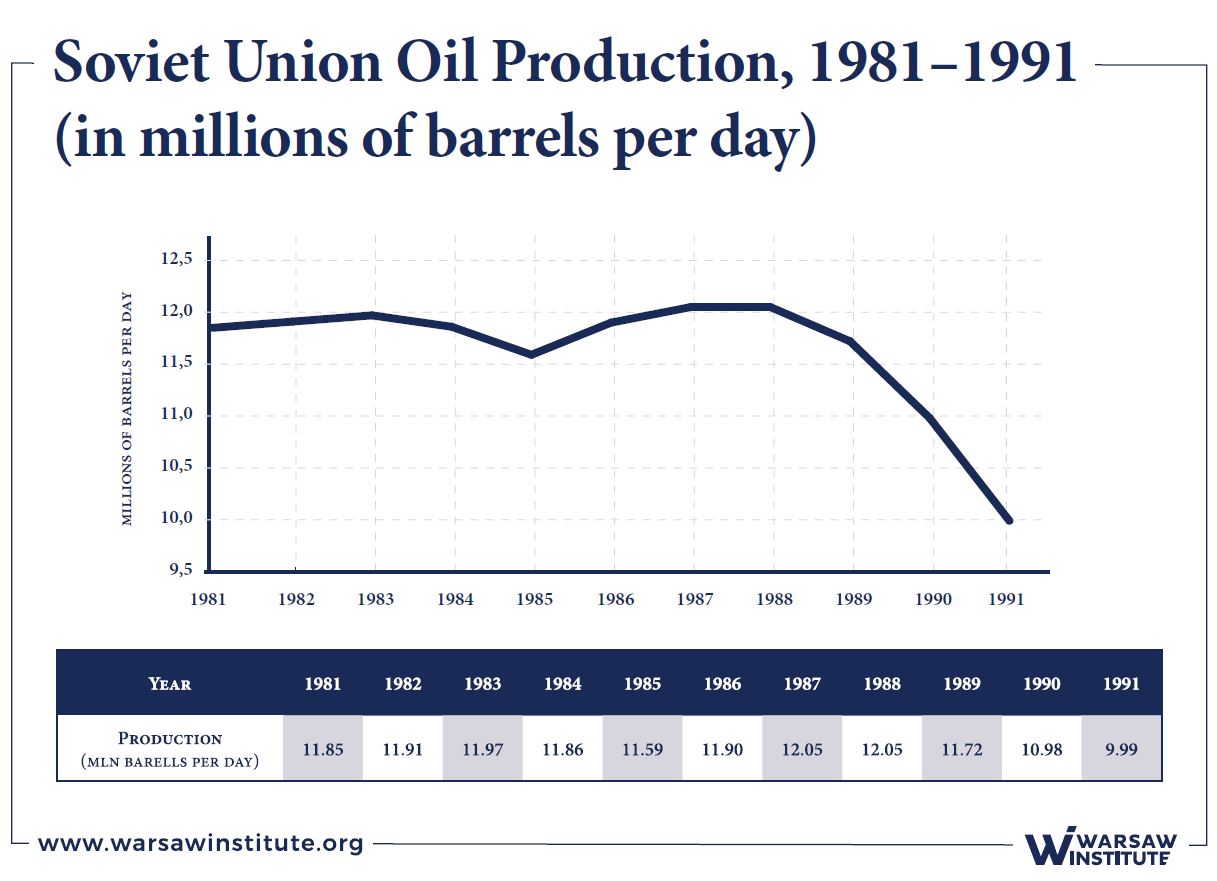

The world’s division into two conflicting blocs, both politically and militarily, was mostly formed in the consciousness of European and North American citizens and it did not really reflect the reality of the period. During the Iran–Iraq War, the conflicting parties tried to destroy each other’s mining, transmission and export infrastructure, resulted in increased prices and volatility in the markets. One of the most feared scenarios was the potentiation closure of both the Persian Gulf and the Strait of Hormuz, restricting oil tankers from operating on the world’s most important oil transport route. All political efforts undertaken by the U.S. government, especially the pressure exerted by the Ronald Reagan administration on its Middle Eastern partners to increase the extraction of the raw material, finally brought about the desired effect. The declines in oil prices, which occurred from the mid-1980s, also contributed to improving the economic situation in the west, while, at the same time, seriously deepening the USSR’s financial crisis. Budget deficits and costs of experimental economic reforms were covered by the profits made from the sales of liquid fuels and crude oil became an export commodity crucial to the state’s existence. At the same time, the USSR was still developing its mining extraction industry. In 1991, the Soviet Union ceased to exist. Nonetheless, its dissolution did prevent further price declines in the raw materials sector or halt the growing surplus on the market.

Simply speaking, the reasons behind this situation may be a result of the political changes that occurred at the turn of the 1980s and 1990s, among which the following events were observed:

– antagonisms among OPEC member states and the decreased ability for the cartel to influence the market,

– putting an end to the Cold War which reduced the oil quantity held in strategic reserves,

– systemic changes in the Russian Federation and the need to adapt the state’s economy to new challenges that emerged following its prospective transition from a centrally planned economy to a free market economy.

With regards to OPEC, such alterations mostly concerned the Middle Eastern members of OPEC. The annexation of Kuwait as well as the military operations targeting Iraq greatly undermined the already limited capacity to cooperate with oil producing countries within the framework of the organization’s provisions. Under the rule of the Shah of Iran, Mohammad Reza Pahlavi, OPEC did not always possess its statutory required cohesion, as evidenced by the 1973 oil shock. Following the Shiite revolution in Iran, the state’s international relations were subject to fundamental changes. Other OPEC member states regarded the change as a threat that was not congruent to their own economic interests. The Iran-Iraq War actively contributed to the cartel’s further disintegration. Shortly after the Iranian revolution, Iraq was also a topic of concern for the cartel. Such actions as its formal annexation of Kuwait or its overt hostility towards any steps undertaken by Saudi Arabia appeared to have a devastating effect on the cooperation between OPEC member states. This was best evidenced by Libya’s preparations to use its armed forces in 1990 and 1991 to liberate Kuwait and use military force against the Baathist regime in Iraq. Therefore, both mining limits and mechanisms that were used to influence prices lost power to shape the situation of the global oil market. All Middle Eastern OPEC member states extracted more raw materials than the joint agreement stipulated and exported them to the global market.

A reduction in strategic stocks of crude oil and fuels concerned not only the United States, although the impact of the reserves in the country appeared crucial for the market situation in general; but also affected, to a different extent, all countries belonging to both political–military blocs . This meant introducing additional quantities of raw materials for sale to the public. The presence of these additional quantities was not just a result of the sale of the oil held in reserves that were to be used in the event of war but simply because there wasn’t any interest in upholding reserve level quantities. This translated into weaker demand, which, coupled with the large surplus of raw materials, ultimately led to a price decline.

The dissolution of the Soviet Union, followed by its systemic transformation, also affected the situation in the global market. This was because the world’s largest producer of crude oil struggled with a chronic shortages of funds that were used for economic modernization and infrastructure development and wanted to reduce adverse social effects arising from these changes, by eliminating its budget deficit through the export of raw materials. Both Soviet leaders, and later (after 1991) also the ruling party in Russia considered the sale of hydrocarbons to be the easiest and most reliable way to gain capital. Since the mid-1990, their approach, accompanied by a similar strategy pursued by OPEC countries, contributed to the expansion of the oversupply of crude oil and the continued price declines. Even after adjusting for inflation, the price level of raw materials at the end of the last decade of the 20th century is extremely low.

Cheap raw materials

Crude oil turned out to be the most versatile raw material in the energy sector. Crude oil owes its popularity to the extraordinary wide range of applications of products manufactured on its basis, including motor fuels, heating material for power plants and heating systems. It is also valued for the lack of logistical complications that could potentially occur during its transport and storage. In addition, crude oil has contributed to the creation of an exemplary solution for the conversion of energy value. The metric ton of oil equivalent (toe) has become a convenient indicator for various energy carriers, whereas the barrel price of this raw material can be a reference point for stock prices of both coal and natural gas.

In March 1998, a barrel was worth as low as 9.50 dollars. Facing this challenge, exporting countries found it difficult to accept this state of affairs. On the fiscal side, the situation also hit consumer countries in Europe where extremely high taxes and customs tariffs on raw material and liquid fuels constituted an important element of budget revenues. The dynamics of oil demand growth, related to such dramatic drops in its prices, could not compensate for the lack of profit from the sale of these fuels. The problem existed not only in the economic but also in the political sphere. EU countries as well as those representing the former Eastern bloc, aspiring to be granted full membership to the union, thought about the potential far-reaching consequences of an economic recession that could affect neighboring states, to which the sale of hydrocarbons constituted a significant source of funds for their budgets. These concerns seemed ubiquitous in all disputes during those times, as evidenced by expert commentaries published in opinion-forming media and in tabloid journalism.

Crude oil reaching an all-time low affected stock prices of all fossil fuels. This simultaneously triggered an increase in their consumption. Multiple changes were noticeable in all energy segments, including refinery production and the generation of electricity. This situation can be illustrated by the dynamics of primary energy consumption.

It raised some questions about limits pertaining to the growth of consumption as well as concerns, which dated back to the 1970s, about the remaining reserves of natural raw materials, along with the lift remaining until these materials are completely extracted. Market players launched a broad debate on peak oil, defined as the point of time when the maximum extraction of crude oil is reached, and the potential repercussions thereof.

Reaching the maximum rate is a natural element of all process cycles and is both predictable and forecasted. This prediction is first evident when the raw material reaches high demand and is essential on the industrial scale. Less than a century and a half later, the world’s addiction to crude oil still may be perceived in terms of an unprecedented phenomenon: no other mineral has ever had such a significant impact on the entire human population.

Peak oil and its ecological determinant

The vision of attaining the supply apogee was always related to fear. Even if the statement can be dated back to the late 1970s, such an approach to the issue of the demand advantage on the fuel market aroused no less emotion by the turn of the 20th and 21st centuries. Countries comprehend both decline of supply, which could translate into further price increases, and even leading to supply shortages in the long term. This anxiety concerns the depletion of all oil resources, however, it also focuses on the negative environmental impact associated with growing global consumption. In this sense, it referred to some climactic changes and the important contribution of greenhouse gas emissions to environmental degradation, not to mention land and atmospheric pollution caused by the combustion of fossil fuels.

However, unlike the above-mentioned sentiment at the turn of the 1970s and 1980s, both scientific achievements and technological progress have depicted new horizons of development without oil, gas or coal. Minimizing the world’s dependence on crude oil in crucial sectors such as maritime and land transport, as well as power engineering, has ceased to be just a mirage. This also occurred with other energy resources, with the exception of fissile elements . Nonetheless, it was not impossible if one assumed that further changes resulted from abandoning the energy production in traditional combustion processes. Yet questions remain regarding the immediate financial costs of the transformation processes, an integral part of which was to implement IT solutions thereby replacing analog systems with brand-new technologies, which was expected to bring about some significant savings in the final balance.

Naturally, raising both the scientific and technical potential enables further modifications to be introduced to the already existing definitions of energy security; yet fear remains a key determinant in the processes of formulating these new solutions. At the turn of the second and third millennium people acquired the fear related to peak oil and its aftermath, as well as possible climate change consequences which would result in the destruction of the earth’s ecosystem.

This anxiety is reflected in one of the most popular and widespread definitions of energy security. Officially, it had been recognized as, „the economic state that would enable the recipients to cover long-term demand for fuels and energy in both technical and economic manner, while maintaining environmental protection requirement”.

Attention should be drawn to the fact that the Polish judiciary has focused on the importance of a system in which the state’s economic life may be organized. However, little space is devoted to the needs of the residents. The economy is treated as an independent entity and its value needs to be protected. One may speculate on the position it occupies in a specific institutional structure or even within any closer territorial framework. Such steps, accompanied by intuitive attempts to determine the state’s standpoint, are not without relevance to any substantive messages within this formula.

Therefore, the unique component of the human security notion is exemplified by some accusations of environmental degradation. They define both time and space in which the aforementioned formula could be elaborated on. Nevertheless, they are the only fragments that could extend beyond this subject criteria.

Conclusion

Both the evolving perception and interpretation of problems related to ensuring „energy security” are usually seen in terms of a natural process. Speaking of its social dimension, it is subject to similar modification mechanisms to those that take place in relation to some of the challenges arising from the need to satisfy existential needs, with particular regard to those whose solution has already been institutionalized either at the state or international level. Nonetheless, its essence affects individuals, which is the reason why it has been exposed.

The standards of living, which derive from factors such as the state of knowledge, ideological awareness, wealth and cultural identity, can also influence opinions on the issue. Emphasis should be put on the price of energy resources and – especially in present times – costs of both manufacturing and the availability of logistical carriers. However, a key role is played by both political and technical determinants. Their superior position stems from their influence exerted on other elements. The case of Berlin’s „life bridge” proves the total depreciation of the economic factor, overwhelmed by political determinants, while the standpoint represented by Arab oil exports in 1973 shall be perceived in terms of its exposure. This situation seems to be corroborated by the events of the late 1970s or the last decades of the 20th century and the appropriate actions on the international arena created this situation on the global market.

Since that time, the rapid scientific progress made in the area of energy generation has made it difficult – or even impossible – to effectively regulate the industry. The commercial potential of this industry could be considered as a circumstance for further dissemination of solutions that have until now only be used by military personnel. It should be remembered that there still anxiety related to the total depletion of crude oil and natural gas deposits, as both resources seem rather easily accessible and cheap. Any further increases in the consumption of this raw material was associated with the progressive degradation of the natural environment . Fear of both the far-reaching effects of such changes and the global economic consequences of a further increase in demand for hydrocarbon raw materials have emphasized the importance of new technologies in the energy sector, which could even be a remedy to these threats.