THE WARSAW INSTITUTE REVIEW

Date: 15 May 2018 Author: Agnieszka Wojnicka

Budget of Necessity

The budget of the Russian Federation invariably depends on the prices of energy products on the global markets. When the value of a barrel of oil drops, anxiety appears in the ranks of Russia’s political leaders, as it increases — a relaxed and carefree approach to using state funds returns.

Addicted to Raw Materials

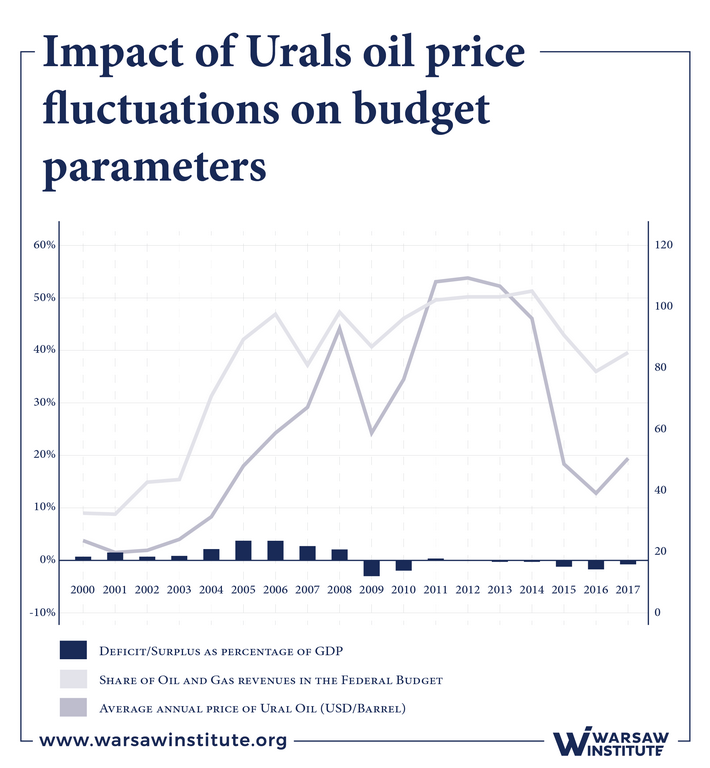

Even in 2001, energy commodity revenues (specifically oil and gas) accounted for nine percent of federal budget inflows. Since then, this share has increased; in 2012–2014 it exceeded 50 percent. With the drop in oil prices on global markets, the Russian authorities announced a reduction in their dependence on energy commodities. The decrease in the share of oil and gas revenues in budget inflows to below 40 percent was announced as a success. However, this resulted not from the deliberate and consistent policy of the government, but from the low prices that determined the reduced inflow of petrodollars.

As an example, the anti-crisis measures of recent years have clearly shown that the only plan of the authorities is to wait out bad market conditions and count on higher prices. When Russia gained the possibility of making a real impact on the upward trend in prices (though not without doubts), it joined OPEC+. However, before it agreed to reduce its output, it increased it to a historic high – 47.5 million tons per month. Even with the limitations resulting from OPEC+ (a reduction of 1.2 million tons), Russia is allowed to extract more than the average 45 million tons of oil per month, extracted before the agreement was signed.

Faced with such conditions, 2017 turned out to be quite unpredictable for the Russian federal budget. This resulted in several amendments to the budget, above all introducing significant changes to the principles of the main financial statute. The projected crude oil price was significantly higher — from $40 in the original version, to $49.90 per barrel by the end of the year. The other important factor was the exchange rate of the Russian currency against the United States dollar. In this case, the direction of the change — from 67.5 to 59.4 rubles to the dollar, was not favorable for the income portion of the Russian budget. Without a strengthening ruble, Russia would have gained over 30 percent more on higher oil prices.

Despite speculation, the authorities have not decided to weaken the exchange rate of their currency. This situation helped importers, which in turn translated into higher revenues from import duties. Inside the country, higher turnover generated higher than expected VAT income, which together with excise duties (which were raised and had their scope expanded) began to balance the inflows tied to energy products.

It is known, however, that Russia does not plan to depart from the energy commodity model. During a press conference in December 2017, Vladimir Putin stressed that Siberia has long been considered Russia’s source of wealth. Currently, the Arctic is to take over this role, because the main supplies of mineral resources are located there. Therefore, to Putin, the deposits possessed there seem to be sufficient to guarantee economic development.

Illusion of Security

The upward trend in oil prices induced the Russian authorities to introduce a new budget rule. According to it, all additional income resulting from the sale of crude oil above the price of $40 per barrel is to be directed to the purchase of hard currency. It is a repeat of the mechanism of creating a “safety cushion” in the form of stabilization funds. It was thanks to the liquid financial resources accumulated in the Reserve Fund and the National Wealth Fund that the government could cover the budget deficit over the last four years. As a result of such fund management, at the end of 2017 the Reserve Fund had been fully spent.

A new pool of funds is essential for Russia to maintain financial stability in the event of another economic crisis. Anton Siluanov, Minister of Finance of Russia, pointed to the target level for reserves of seven percent of GDP. In March 2009 in comparison, funds equivalent to twelve percent of GDP were collected in the Reserve Fund, and two years later only a little over one percent remained. The reserves restored in February 2015 to over seven percent of GDP no longer exist. Thus, resources of this size would allow Russia to survive only one phase of the crisis.

The Central Bank of the Russian Federation has been purchasing currency for the Ministry of Finance since February 2017. And although monthly statistics are provided on energy commodity surpluses, detailed reporting is missing. No additional funds have been provided to the National Wealth Fund. Formally, they should be on the Federal Treasury’s accounts. However, we know that in the 2017 budget amendments, Russia raised the assumed level of oil prices and divided additional revenues, while simultaneously reducing the deficit. The Ministry has already announced a spring amendment to the budget of 2018 and a change in its basic parameters, and probably also the base price of “black gold”.

Prospect of Stagnation

It seems to the authorities that when the prices of raw materials reach a satisfactory level, they can breathe a sigh of relief. Meanwhile, many economic forecasts indicate that this will not significantly influence economic growth. The problems are structural in nature and manifested themselves before 2014 and the introduction of sanctions and counter-sanctions. These predictions are confirmed by preliminary macroeconomic data for 2017. GDP growth was 1.5 percent, significantly lower than the expected 2.1 percent. Russia has been lagging behind the global average (three percent) for yet another year, so in practice its economic development is stagnating. After optimistic indicators at the beginning of 2017, the following months brought only disappointment with the impermanence of the improvement in the economic situation. Along with the low growth of industrial production, declining investments, prolonged decline in real incomes of the population and the persistence of external conditions, the forecast of stagnation is ever more real.

The authorities want the economy to be based on internal demand and investment. However, the crisis has been shrinking the real income of Russians over the last four years — according to official statistics, by more than eleven percent. This has distanced the prospect of a return to the pre-crisis level of 2013. So far, the authorities are counting that in the case of salaries, this will happen by 2022. Worse projections concern retirement funds, which are not expected to regain their real value from before the crisis until as late as 2035, despite the expected increase in the retirement age.

As a result, Russians are saving less and are increasingly living on credit (in January-November 2017, loans were granted for a larger sum than assumed deposits). This limits the possibilities of the second component of growth that the authorities are counting on — investments. To this end, plans were made to encourage Russians to invest. A bond issue program for individuals was launched, which was also supposed to finance the budget deficit. After an initial wave of interest, demand has begun to fall. The government, however, as if ignoring this issue, plans to triple the annual issue volume.

The large governmental investments, one-off boosts to economic indicators (construction of the Siberian Force, the bridge to Crimea, infrastructure for the needs of the FIFA World Cup), are also coming to an end. The international situation is significantly hampering the inflow of foreign capital. Gazprom and Rosneft projects relate to the mining sector, and therefore remain selective and support the dependence of the economy on raw materials. Financial sanctions have also drawn out funds from the internal market, reducing the investment opportunities of small and medium enterprises in other sectors.

The loyalty of state-owned companies to the budget also remains debatable. Only half of the expected dividends which were to be obtained by the federal budget in 2017 materialized. Although a minimum of 50 percent of earned profits should be transferred into the budget, unofficial lobbying within the administration allows state giants to avoid these obligations. The assumed dividend income in 2018 is thus also considered inflated, so the Ministry of Finance must create a reserve for such shortfalls.

Expenses Beyond the Real Economy

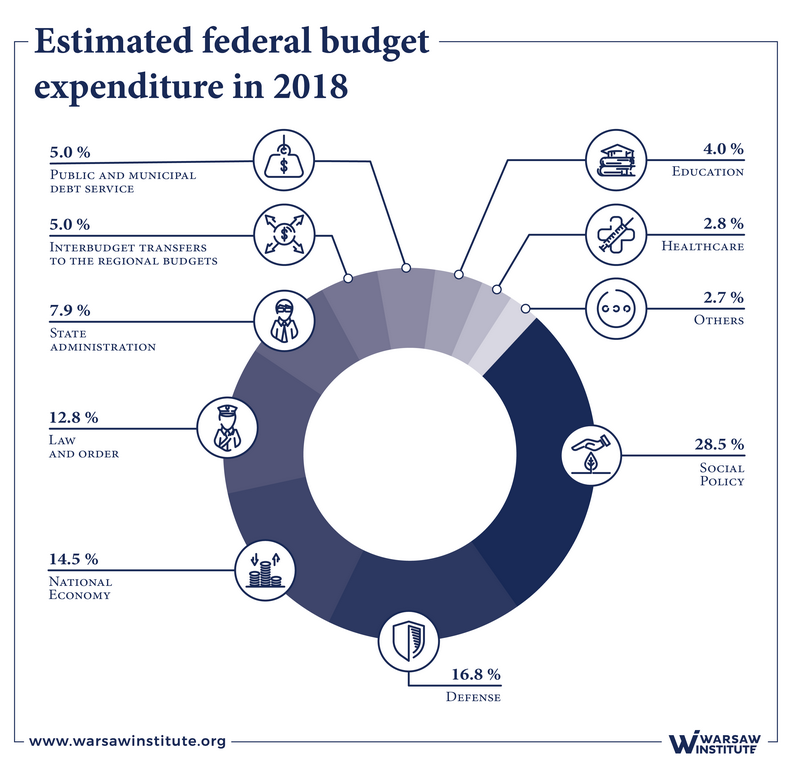

The expenditure side, similar to income, is quite polarized. More than half of the budget is focused in two basic directions: social policy (mainly social support and transfers to cover the Pension Fund deficit) and national defense. The socio-military character of budget expenditures has been characteristic of Russian policy for several years and is expected to remain so at least until 2020.

The 2018 budget provides for about 30 percent total expenditure on social policy (4.8 percent of GDP, in 2017 it was 5.4 percent of GDP). About 17 percent goes to national defense (3.1 percent of GDP in 2017, 2.8 percent in 2018), and another 13 percent for internal security and public order (2.1 percent of GDP). In the last two years, despite the high level of defense spending, it rose again as part of the amendment to the budget. This was necessary in order to repay bank loans guaranteed by the state, which armaments companies incurred to implement projects for the armed forces.

Expenditure to support the national economy is in third place (2.5 percent of GDP). Despite the government’s declarations, by 2020 these expenditures are expected to decline, both nominally and in relation to GDP (to 2.2 percent). Among the five largest departments in terms of the amount of budget funding (they accumulate 70 percent of the budget and about eleven percent of GDP), only this directly relates to the real economy. The budget therefore lacks a clear basis for stimulating economic growth and development of human capital. Although spending on health care and education in 2018 will increase, the trend is not permanent and is only tied to the election season.

A special innovation in the budget for 2018–2020 is that part of the expenditure on the economy, will be at the sole disposal of the president. Its share will increase from year to year, from $2.3 to $6 billion. Currently, it is not known exactly what the funds will be spent on, it is speculated that it will be financing for economic reforms. Their introduction is to be delayed only due to the electoral calendar. The availability of funds through presidential decrees circumvents the need for legislative approval and allows for selective and “manual” control of support for the economy. It is also possible that they will be used to support oligarchs loyal to the Kremlin, whose number, including on the US sanctions list, is expanding.

A characteristic element of the budget is also a significant share for secret expenses, amounting to 18 percent. This means that almost every fifth ruble of the federal budget cannot be accounted for. The level of secrecy also increases in the sections not directly related to the sphere of security. The financial act for 2018 assumes that part of the cash transfers to Russian entities will be secret. Therefore, it is not known which unit will receive additional funds and how much. Such an action may have several reasons — a desire to hide the difficult financial situation of the regions (which could trigger social tensions) and to thus avoid setting up a queue of governors, demanding similar assistance. At the end of 2017, some of the regional administrations turned to the federal center for additional support, admitting that they lacked money to pay wages in the public sector or service their debts. This is information that the Kremlin would prefer to obtain unofficially, and not with the involvement of the media. In turn, in January 2018, the federal tax administration introduced external supervision over the budgets of two entities that are excessively in debt. However, there are more such units, so that further such actions are possible.

Management of the Deficit Problem

During the period of prosperity on the raw materials market (the first nine years of Putin’s rule), Russia was used to ending the budget year with a financial surplus. Since 2009, the situation has been reversed — except for a small surplus in 2011, the Russian budget has been in a permanent deficit. The lack of systemic reforms and a well-thought-out development strategy meant that during the last two crises (2009–2010 and 2015–2016), the basis for financing budget shortfalls was the petrodollar reserves. As already mentioned, one of them has been completely depleted. The deficit of subsequent years (the current budget perspective assumes its maintenance until 2020) is to be covered by the National Wealth Fund and internal debt.

First and foremost, the liquid and reliable National Wealth Fund resources will be used. In 2018, they will cover almost 90 percent of the projected deficit. The Ministry of Finance has timidly indicated that with current oil prices holding, a budget surplus is even possible. However, certainty in this respect will be possible only at the end of the year. This is indirectly due to the fact that it is still unclear whether the election victory of Vladimir Putin will be followed by changes or whether the conservative approach to the economy will remain. Various kinds of proposals and speculations appeared in the media (including raising the tax on individuals from 13 to 15 percent or the retirement age), but Putin himself did not present a concrete electoral program with proposals for reforms in the next term of office.

If the forecasted level of the deficit is maintained, Russia may have problems with its financing after 2018 due to its focus on internal sources. Foreign debt, due to international conditions, will not play an important role. The problem for Russia is not the debt level, which is relatively low at present (less than 14 percent of GDP, and to increase to 16 percent in 2020), but the fear of insufficient internal market resources. The first factor, noted previously, are shrinking household finances — interest in purchasing Treasury bonds is waning. State-owned companies compete with state securities, also have limited financing opportunities abroad. Large private companies can join the race away from Treasury bonds, which, as the last stage of imposed American sanctions showed, even if they are not their object, are beginning to be treated by investors as “toxic” assets. Competition for limited internal financial resources may also result in an increase in the level of conflicts between the ruling elites.

If, however, the worst-case scenario is avoided, Russia should have the ability to manage its deficit financing. It is also worth remembering that a kind of “life preserver”, already used in 2016, could be the privatization of state-owned companies that will enrich the federal budget.

Undoubtedly, even by adopting the “wait out the storm” strategy, Russia managed to survive the latest economic crisis. However, the exit from it was to a large extent due to the improvement in the global commodity markets and the stabilization of the economy after the shocks of 2014–2015.

All texts published by the Warsaw Institute Foundation may be disseminated on the condition that their origin is credited. Images may not be used without permission.